- Cipher Digest

- Posts

- Binance and Coinbase Sued, Trading Ideas & Market Analysis | Cipher Digest

Binance and Coinbase Sued, Trading Ideas & Market Analysis | Cipher Digest

📈 Tuesday's Cipher Digest: Binance and Coinbase Under Fire! Navigating the Crypto Market Pressure and Traditional Finance Woes

Welcome to Tuesday's Cipher Digest, your go-to source for top-notch content AND a friendly companion (that's me, your friend in the know) who genuinely cares.

In today’s digest:

📈 Tuesday Technicals

Binance and Coinbase SUED

Impact on the market and BTC outflows

💡 Tuesday's Trading Ideas

Strategies for navigating current market conditions

Short-term game plan for BTC and ETH

🔒 Crypto Market Analysis

SEC lawsuits against Binance and Coinbase

Implications for the broader crypto industry

💼 Traditional Finance

Wall Street's Reaction to the recent surge in the S&P 500

Tuesday Technicals

Data indicates Binance users have overall withdrawn almost $1.5 billion from the crypto exchange over the past day, as the firm grapples with a fresh Securities and Exchange Commission lawsuit over alleged securities violations.

The SEC claimed the exchange and its CEO “CZ” lured US customers to their unregulated platform and mixed investors’ funds with their own.

It’s important to note though, even with a huge withdrawal, it’s a BLIP for a firm the size of Binance.

Assets on the platform last stood at just under $60.2 billion, according to DeFiLlama.

This tweet from CryptoQuant founder shows the real significance of the BTC outflows.

This demonstrates the statistical significance of the 'biggest $BTC outflows on @binance this year.'

— Ki Young Ju (@ki_young_ju)

10:54 PM • Jun 5, 2023

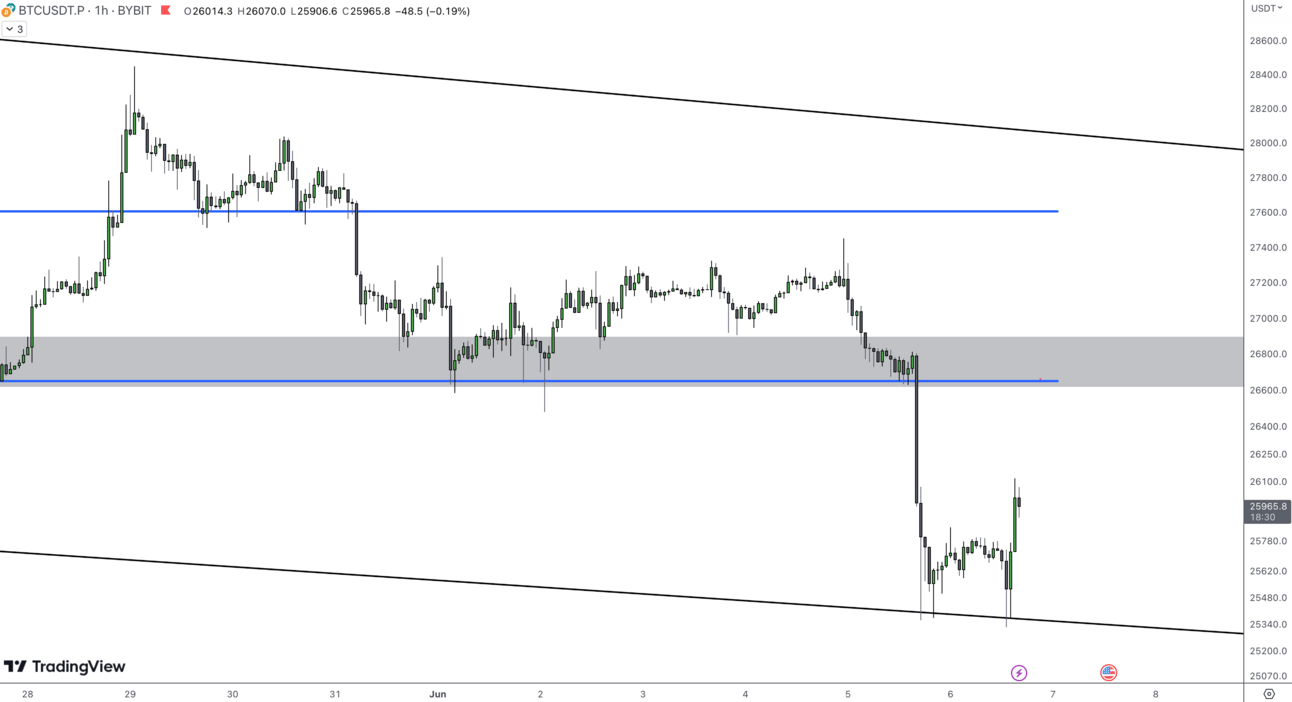

The chart below shows TOTAL (Total Crypto Market Cap), which fell by ~$52 billion yesterday after the Binance news. Similarly to the $BTC chart, we are at key support at the bottom of a potential bull flag.

Some decent news for investors is that today after the SEC announced a lawsuit against Coinbase, we didn’t see a huge reaction in price.

Now onto BTC price…

BTC continues its path lower, as expected. The Head-and-Shoulders pattern is working as planned and is dragging prices lower towards its profit target of $24k-$25k.

Currently, the price is holding on the bottom of the bull flag, which we shared in our prior market updates. As shown below, we could have a short-term “double bottom”, which encourages us to believe we will see a small move to the upside to eliminate short sellers from the market, before a larger move down.

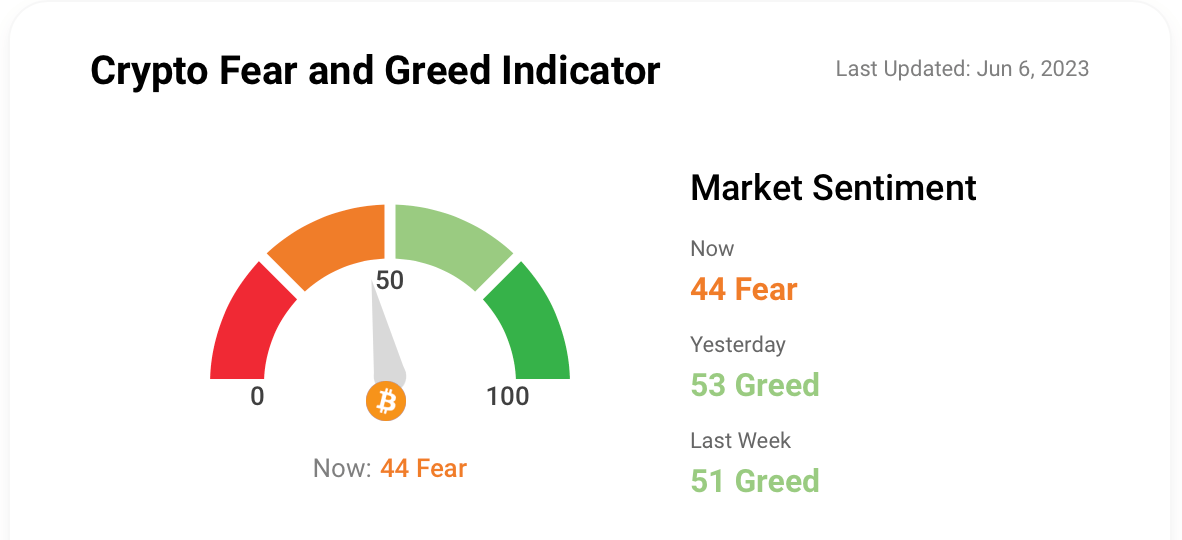

Market sentiment is also surprisingly strong despite recent events, leading us to a short term move up to the resistance as marked on the chart above.

Tuesdays Trading Ideas

We wont be as active in the current markets (obvs due to the rapid news), but we do have a plan.

We are currently watching for markets to try and wipe the shorts from the market and make its way back up to ~$26600. Here, we will then look for failed swing highs and reclaims to then short back down to $25000.

For ETH, I have a similar short-term game plan to look for shorts at the key retracement levels (in red), which also happen to be the Weeks Open. Would then look to short down to last month’s lows.

The orange zones marked above, show where I would be looking to short.

For more in-depth and daily trade ideas, join us for free on Discord.

The Crypto Market is Under Pressure.

On Monday, the SEC sued Binance and CEO CZ for U.S. securities violations alleging that Binance violated U.S. securities laws.

Take a look at this thread for a simple breakdown of the 130+ page lawsuit:

BREAKING :

The #SEC is launching an attack on not just @binance, but the crypto industry as a whole, including:$SOL, $ADA, $MATIC, $FIL, $ATOM, $SAND, $MANA, $ALGO, $AXS & $COTI

Here’s EVERYTHING you need to know 🧵

— Asim (@cryptasim)

5:45 PM • Jun 5, 2023

The SEC's action is part of its ongoing efforts to regulate the rapidly growing crypto industry. The SEC is seeking various remedies, including monetary penalties and injunctions to halt Binance's alleged illegal activities in the US.

As if that wasn’t a hard enough day for crypto investors…

This morning, the SEC sued Coinbase over its exchange and staking programs alleging that Coinbase has violated securities laws by offering crypto-based exchange and staking programs without proper registration and compliance with regulations.

As a result of this news, Coinbase's stock experienced a significant drop of 14% following the announcement of the lawsuit.

The outcome of these legal battles will likely have implications for the broader crypto industry, as it may shape how regulators view and regulate similar activities in the future.

Much of the market current feels as this is a larger threat by the US Gov on the whole crypto market and not just the exchanges. Here are some interesting takes:

This is all small ball compared to the final boss: CBDCs as a totalitarian surveillance tool designed for control vs. Bitcoin as decentralized freedom money

When not if, Bitcoin will win and prosper

— Will Clemente (@WClementeIII)

1:50 PM • Jun 6, 2023

Why did the SEC let Coinbase go public with all these illegal securities listed on it?

— Frank Chaparro (@fintechfrank)

12:36 PM • Jun 6, 2023

>SEC sues Coinbase, says operated as an unregistered broker since 2019

>US gov sells billions worth of BTC via Coinbase since 2019

— Hsaka (@HsakaTrades)

12:55 PM • Jun 6, 2023

Traditional Finance

It was a day of mild excitement on Wall Street as traders digested the recent surge that sent the S&P 500 soaring to its highest level in NINE MONTHS.

Now, let's talk about banking shares.

They didn't have the best day, my friends. Reports came in suggesting that there might be some discussions about increasing capital requirements for big financial institutions.

As a result, big players like Goldman Sachs, Bank of America, Morgan Stanley, and JPMorgan saw their stock prices take a dip of about 1% on Monday. !

Why should they be worried…I wonder…

But wait, there's more! The SPDR S&P Bank ETF, which tracks the performance of the banking sector, experienced a decrease of around 2.2%.

Despite the recent surge in the S&P500 futures, the index is trading right at the top-end of this rising wedge pattern while the RSI is also capped by a symmetrical triangle pattern.

The market remains bullish, there is no doubt about that. However, it seems that the trend is showing signs of exhaustion as there is less bullish momentum coming in the market.

It’s just a shame the crypto market is being held down and lost its strong correlation to the tech market.

Meme of the Day

Today’s memes, will be based on the recent news brought to us by the SEC.

Here’s a great thread compiling some of the markets best memes by @CryptHoeem.

SEC vs crypto.

A story of memes: 🧵 👇

— hoeem (@crypthoem)

2:07 PM • Jun 6, 2023