- Cipher Digest

- Posts

- Binance FUD Continues, BTC Analysis, SP500 in a bull market + more | Cipher Digest

Binance FUD Continues, BTC Analysis, SP500 in a bull market + more | Cipher Digest

We dive into everything you need to know about this market this past week!

TGIF. It’s been a busyyy week in the crypto space and we think the weekend will be spicy 🌶️ too.

As always, we are here to cover everything in the market, so you can act smart in front of your family.

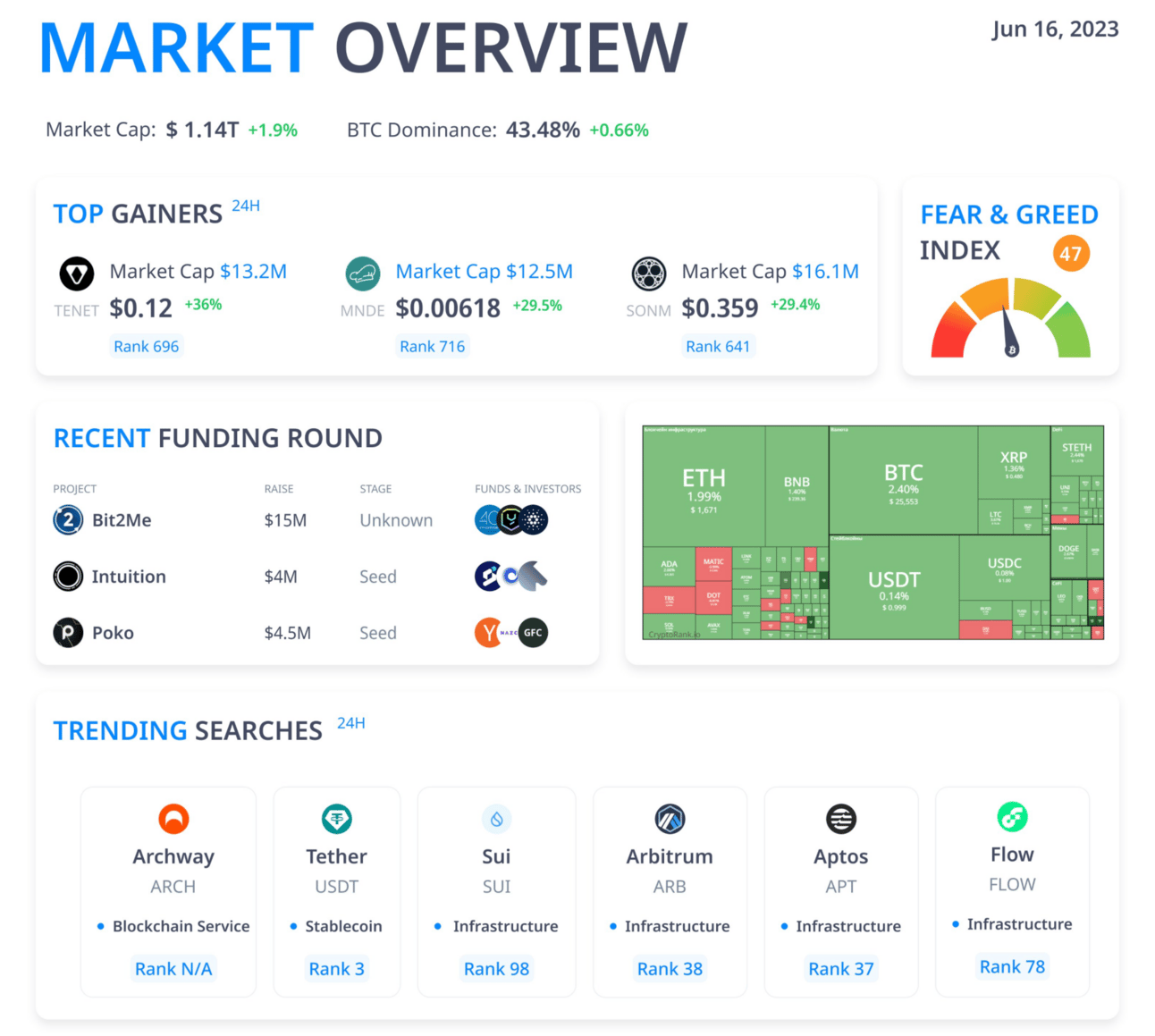

Here’s a market overview and what you can find in today’s digest:

In Todays Digest:

Latest Web3 News🚨

The Reason the US is Attacking Crypto 🔍

Fact of the Week 📚

Crypto Market Analysis 📈

TradFi Milestones This Week 🧐

Tweet of the Day 🐦

Before we get into it, remember to join our Discord for FREE for more breakdowns, a chatroom, and daily trading signals.

We have been on 🔥🔥🔥 this week 👀

Latest Web3 News 🚨

Uniswap V4 was revealed, the new iteration enabling new capabilities such as limit orders and reducing the gas fees for swaps & pool creation

Polygon Labs announced Polygon 2.0, a HUGE set of upgrades

BNB Chain announced the launch of its layer 2 scaling solution on June 19th

Taiko, an Ethereum L2 that targets full decentralization, raised $22 million in funding across two funding rounds

MultiversX added support for BTC and ETH

Aevo, a decentralized derivatives exchange, is now fully live on mainnet

The Graph, a blockchain data indexing and querying protocol, began migrating to Arbitrum

🚨Binance.US market share drops to 1%🚨

— Kaiko (@KaikoData)

10:07 AM • Jun 16, 2023

Binance has shut down ops in the Netherlands and also seen a HUGE wave of FUD, in France.

According to multiple reports, the French Regulators are clamping down and investigating Binance for money laundering.

Since this claim, Binance CEO (CZ), has shut down the claims and put things straight:

4. FUD.

In France, surprise (no advanced notice) on-site inspections of regulated businesses are the norm, for banks, and now for crypto too.

The surprise visit for Binance France happened a couple of weeks ago. It's not "news". Binance France cooperated fully.

Binance also… twitter.com/i/web/status/1…

— CZ 🔶 Binance (@cz_binance)

12:55 PM • Jun 16, 2023

What to Watch (US Gov Narrative) 👀👀

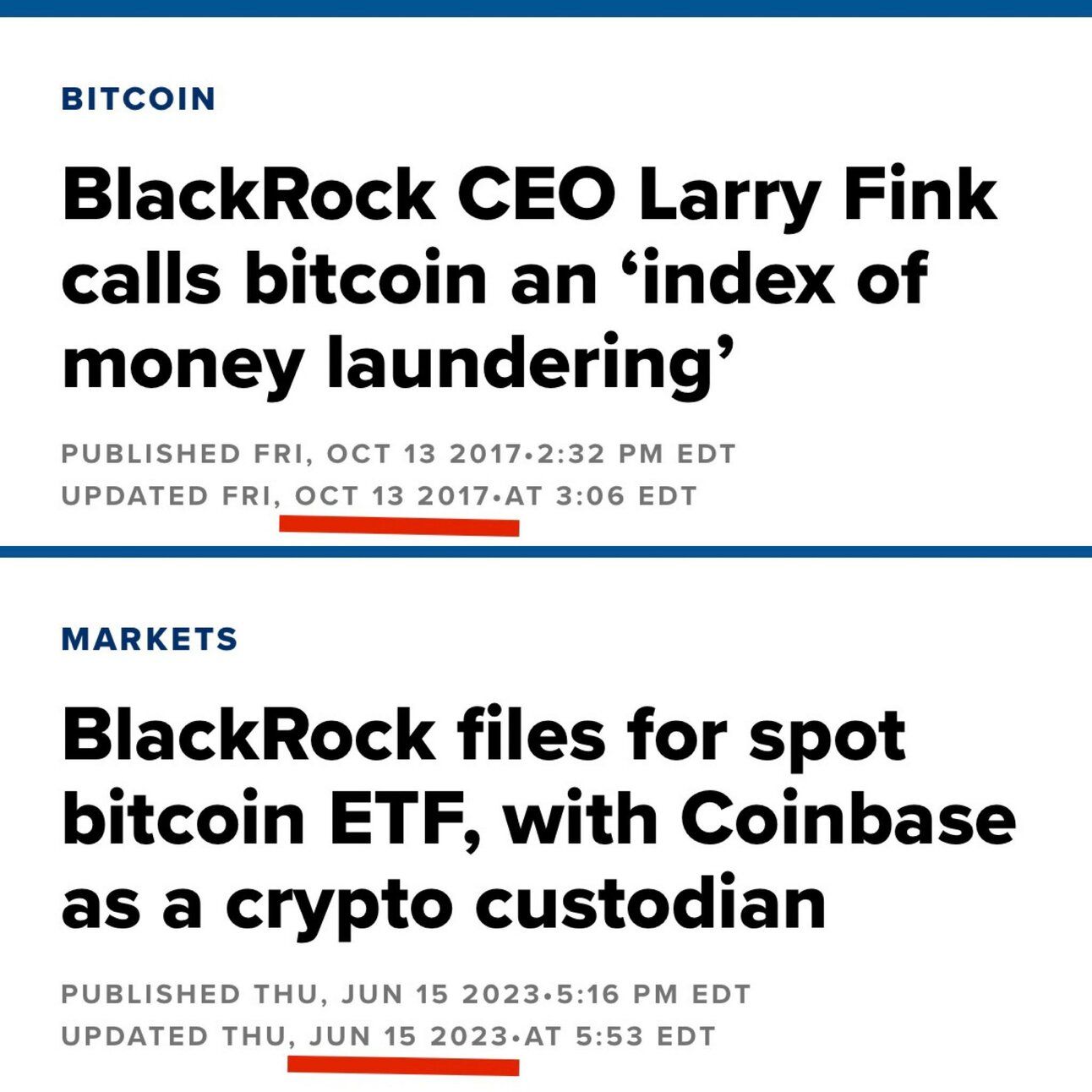

The SEC is "killing" crypto so they can control crypto. The playbook:

Cut the on/off ramps to starve the ecosystem of liquidity (limiting existing crypto businesses' earnings)

Create a dubious regulatory environment to deter new startups from entering the space

Purposefully deny regulatory licenses to crypto businesses + take legal action against them

Pave the way for TradFi institutions to take over the space by granting them the appropriate approval (today BlackRock filed for a $BTC ETF)

The SEC doesn't like the idea of "crypto cowboys" controlling the industry. They'd rather give licenses to companies they know they can control (or companies that "control” them).

Fact of the Week 🗣️

Buying a Home has Become a Luxury

The average interest rate on a 30-year mortgage is now above 7.0% despite the Fed pausing rate hikes.

The average monthly mortgage payment is now up to $2,400. Meanwhile, the average home is now renting for a RECORD $2,000.

US regulation, inflation and rate hikes, are tightening around the necks of the average American. We are seeing spending decrease globally and credit usage rising.

Why Am I Telling You This? 🧐

Be smart with your money. Times are tough and will only get tougher, position yourself accordingly.

Crypto Market Analysis 📉

BTC has fallen to the bottom support of the bull flag at around $25k, which we have mentioned over the past couple of weeks. Not to mention that $25k is also a psychological support level.

As shown on the chart above, the recent market crash, held perfectly on our support. Since then, we had a brief run up to $25.7k, failing to make a new high.

In my opinion, I am looking for a BTC move to the downside and will place shorts if we see a 4H candle closure BELOW the black trend line support.

Remember that there is a CRAZY amount of OI (Open Interest), in the markets right now. What does this mean? A huge number of people expect the market to fall and they all have open shorts.

This is why i’m not opening shorts right now, I believe they must get liquidated and THEN we will see a truer move down.

TradFi Outlook 📊

Market sentiment regarding the possibility of a banking crisis in the US has diminished, but there are still indications of ongoing concerns among certain firms.

The amount of money borrowed through the Federal Reserve's emergency lending facility has increased for the sixth consecutive week, remaining above $100 billion.

Key market milestones for the week include:

The S&P 500 saw a 3% increase, marking its best performance since March.

This is the fifth consecutive positive week for the S&P 500, a streak not seen since November 2021.

The benchmark has risen by over 26% from its low point during the bear market.

The Nasdaq has now seen eight consecutive weeks of gains, its strongest winning streak since 2019.

Both the Nasdaq and S&P 500 saw six consecutive days of gains until Thursday.

The S&P 500 and Nasdaq are currently at their highest levels since April 2022.

This week, the Fed met investor expectations by maintaining unchanged interest rates after a series of ten consecutive rate hikes.

Although the Fed indicated the possibility of two more rate increases later in the year, many traders believe that the Fed may be nearing the end of its tightening cycle.

Tweets of the Day 🐦

Fun Fact: Stablecoin FUD often marks local bottoms.

— Miles Deutscher (@milesdeutscher)

9:57 AM • Jun 15, 2023

NEWS: Binance announces metaverse featuring The Weeknd while under fire by SEC

blockworks.co/news/sued-by-c…twitter.com/i/web/status/1…

— Blockworks (@Blockworks_)

2:01 PM • Jun 16, 2023