- Cipher Digest

- Posts

- Binance vs. SEC Drama Unveiled 😱, ETH bullish?! and more | Cipher Digest

Binance vs. SEC Drama Unveiled 😱, ETH bullish?! and more | Cipher Digest

Binance vs. SEC Drama Unveiled 😱, ETH bullish?! and more | Cipher Digest

Welcome to another Cipher Digest. It’s Thursday… so it’s almost TGIF? Thats all I can think of that’s positive about a Thursday tbh .

What to expect in todays Digest:

Binance vs. SEC Drama Unveiled 😱

Simplifying Crypto Whitepapers with Bard's Help 📚

The Truth Behind Misleading Market Assumptions 📊

Crypto Market Analysis 🔍

Tradfi Market is primed for a big move?!

Tweets of the Day 🐦

Latest News

As you would expect most of the crypto space drama is based around…drumrolll pleaseee… BINANCE AND THE SEC! (im tired of it already tbh)

It turns out that Binance's lawyers are claiming something quite unexpected. Despite the ongoing lawsuit and Gensler's tough stance on the crypto industry, they say that Gensler actually applied to be an advisor for Binance.

Binance wants Gary Gensler to recuse himself from SEC lawsuit theblock.co/post/233758/bi…

— The Block (@TheBlock__)

12:14 PM • Jun 8, 2023

Talk about a plot twist!

According to documents filed for the lawsuit, two of Binance's law firms, Gibson Dunn and Latham & Watkins, are making this accusation. They allege that Gensler reached out to Binance and its founder, Changpeng Zhao, in March 2019, offering his services as an advisor.

It seems there were some conversations, and the story gets even juicier. Gensler and Zhao even met up for a fancy lunch in Japan later that month. How scandalous!

But wait, there's more! The lawyers claim that Zhao and Gensler stayed in touch after that initial meeting. In fact, at Gensler's request, Zhao even participated in an interview for a cryptocurrency course that Gensler was teaching at MIT.

Now, let's fast forward to later in 2019. Gensler was scheduled to testify before the House Financial Services Committee, and guess what? He allegedly sent Zhao a copy of his testimony ahead of the hearing. Oh, the drama!

Luckily there’s more news that isn’t to do with the SEC… but it isnt good news. lol

FCA Puts the Heat on Crypto Ads

The UK's financial watchdog is tightening rules around marketing crypto, including banning so-called "refer a friend" bonuses

The FCA's Sheldon Mills says the changes send the message that digital assets are "high-risk investments" trib.al/mfDaeVc

— Bloomberg Crypto (@crypto)

6:53 AM • Jun 8, 2023

Hold on tight, because the UK's Financial Conduct Authority (FCA) has some new rules in store for crypto advertisers. Starting from October 8, things are going to get tougher for those promoting crypto services.

The FCA recently announced that crypto companies will have to implement a "cooling-off period" for first-time investors.

But that's not all. The FCA is also cracking down on those pesky "refer a friend" bonuses. Those schemes will be banned as part of the FCA's efforts to ensure that crypto investors truly understand the risks involved. It's all about keeping everyone safe in the wild west of cryptocurrencies.

In their announcement, the FCA highlighted that these steps align with the restrictions they introduced last year for advertising high-risk investments. So, it seems they're keeping a close eye on the crypto space and taking action to protect investors.

BARD AI 🤖

Whitepapers are one of the most important resources to anyone investing in a crypto project, but reading them can be a pain in the a**.

I use Bard to make this much much more simple:

Now any n00b can copy and paste links into Bard and get a summary but the key here is understanding what info we need and the best prompts to get that info out. Here’s what we need from each whitepaper, and the best prompt to use:

Overview of the project

“Can you give me an overview of this whitepaper?”

How does it work?

“Can you explain, in simple terms, how the crypto project works??”

Economics

“Can you explain to me the economics of this whitepaper, in simple terms”

Tokenomics

“Can you explain to me the tokenomics of this project? Please highlight any possible areas of concern.”

Governance

“Can you explain to me the governance protocol for this project?”

Risks

“What are the risks associated with investing in this project, from a project overview standpoint?”

Chart of the Day

Todays CoD, comes from Tier1 Alpha on Twitter.

It’s a perfect example of “not all things are as they seem”.

In context for the below chart, the SP500, posted a red day as an index. This would be enough for most people to then make a bold assumption that the US stock market had a negative day.

In the graphic below, we can see that instead, the reality is that some of the largest stocks in the SP500 basket, were negative. A majority of the SP500 was actually in gains on the day.

It’s a simple but important lesson that comes from this:

ALWAYS INVESTIGATE FACTS

Things are often more than they seem, whether it’s news from a major org, or a chart shared by an influencer, look into it and understand the details yourself.

Some extreme market cap distortion today.

Despite $SPX closing in the red, 69% of the index had actually advanced for an average gain of 1.83%!

Things were more bullish than they appeared.

— Tier1 Alpha (@t1alpha)

8:26 PM • Jun 7, 2023

BTC Update

In recent times, the SEC has made significant announcements that have had a notable impact on the short-term volatility of both BTC and ETH.

Notably, BTC's 20-day volatility exceeded that of ETH, marking the FIRST instance since March where BTC has exhibited higher volatility levels compared to ETH. (something to keep an eye on)

ETH showing great strength.. or delayed reaction?

This development in the market has triggered a surge in daily trade volume, reaching its highest level since April. The trading activity has surpassed $21 billion, indicating heightened market participation. Additionally, the increased volatility has also led to a significant rise in liquidations, totaling approximately $400 million.

From a technical perspective, BTC continues to trend lower. On an intraday basis, the 27,600 resistance is an important one that is located right at the top of the previous trading range. Expect more volatility and sideways price action between the pivot low near 25,250 and 27,600.

Looking at the daily chart, as long as prices remain capped by this declining trend line as well as the 50-day moving average, then we should expect further downside towards 25,250 and 24,000 in extension.

Reminder to join the Cipher Discord community for access to more in depth breakdowns and trade ideas!

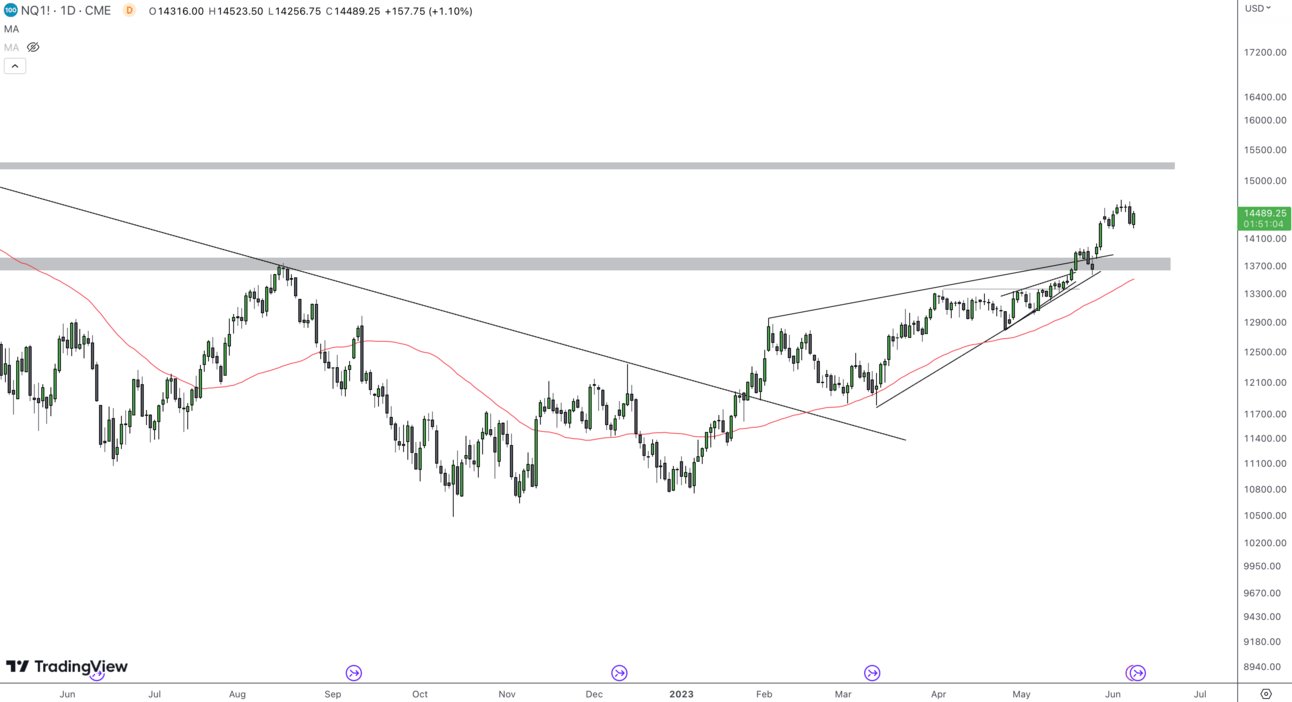

Traditional Finance

The stock futures showed minimal change on Thursday, as market participants eagerly anticipate the next catalyst.

With earnings reports concluded and the resolution of the debt ceiling issue, attention now turns to the upcoming Federal Reserve meeting next week on June 14th.

Both the S&P500 and Nasdaq have retraced from the upper bounds of their ascending wedge patterns.

While a temporary recovery may occur given the sharp decline, our overall perspective is that the US indices will likely continue to decline towards their respective 20-day moving averages which is 1.6% away for the S&P500 and around 2.4% away for Nasdaq. (remember this refers to the index ;))

Crypto Spotlight - Polygon (MATIC)

The United States House of Representatives Energy and Commerce Committee’s Subcommittee on Innovation, Data and Commerce gathered to discuss blockchain technology and the future of Web3 on June 7.

This meeting was held just after the SEC announced back-to-back lawsuits against major crypto exchanges Binance and Coinbase.

Polygon Labs president Ryan Wyatt and several legal experts, appeared before the committee and tbhh… it seemed constructive.

Wyatt began by addressing the fundamental problem blockchains solve — the “value extraction” problem on the internet.

He explained that in the current era of the internet — “Web2” — large centralized tech companies extract value from users by charging fees for goods and services and collecting user data for their benefit.

Polygon Labs exec said the U.S. could maintain its competitive edge and ensure the technology industry thrives domestically:

“When regulation does not meet novel technology where it is, the U.S. loses its competitive edge over other countries.“

Tweets of the Day 🐦

List of Cryptocurrencies Considered as Securities by SEC

The number of tokens labeled as securities by the US SEC has risen to around 55 (excluding 13 tokenized stocks), following the inclusion of additional ones in the Binance and Coinbase lawsuit.

👉 cryptorank.io/watchlist/747c…twitter.com/i/web/status/1…

— CryptoRank Platform (@CryptoRank_io)

11:29 AM • Jun 8, 2023

If you're the SEC and you really want to kill crypto, then your next target would be Tether.

Why?

76% of all stablecoins on exchanges is USDT.

Why not go straight for the jugular and starve crypto of its liquidity..

— Miles Deutscher (@milesdeutscher)

4:00 PM • Jun 7, 2023