- Cipher Digest

- Posts

- BlackRock CEO Backs Bitcoin as Digital Gold, Whales Making Big Moves - Get the Inside Scoop! | Cipher Digest

BlackRock CEO Backs Bitcoin as Digital Gold, Whales Making Big Moves - Get the Inside Scoop! | Cipher Digest

Uncover the Startling Endorsement of Bitcoin by BlackRock CEO, Unleash the Power of Whales in Shaping the Market, and Gain Exclusive Insights from Industry Insiders!

G’day mates. This is your daily Cipher Digest, your backstage pass to the crypto circus. Step right up and witness the greatest show on the blockchain…Elephants not included.

In Todays Digest:

Market Overview 👁️

Latest in Web3 🚨

World’s Largest Investor LOVES BTC?! 👀

Chart of the Day 📊

Crypto Market Analysis 📈

TradFi Market Outlook 🧐

Crypto Word of the Day 🤌🏽

Latest in Web3 🚨

BlackRock CEO says crypto is digital gold and "Bitcoin is an international asset."

NEW - BlackRock CEO is now promoting crypto and Bitcoin.

— Disclose.tv (@disclosetv)

8:50 PM • Jul 5, 2023

Valkyrie refiles for spot Bitcoin ETF with Coinbase

CFTC concludes Celsius and former CEO violated US regulations

Circle considers issuing stablecoin in Japan under new rules

Saxo Bank ordered to liquidate its portfolio of crypto assets by the Danish regulator

World’s Largest Investor LOVES BTC?! 👀

Investors and traders all together showed upbeat sentiment after Larry Fink, the CEO of BlackRock, expressed the company's intention to simplify and reduce the cost of investing in Bitcoin. (the big dawgs are into crypto)

In his Wednesday interview on Fox Business News, Fink compared Bitcoin to digital gold. (wow so when I say this, its a lie, when he says it, it makes headlines)

He did admit that he doesn't personally own any though.

"In terms of Bitcoin, as I've previously mentioned, we have faith in the digitization of products," Fink elaborated.

He described Bitcoin as an international asset that offers an alternative investment opportunity for people.

These are the upcoming spot Bitcoin ETF deadlines:

Chart of the Day 📊

The MVRV Z-Score is a metric used in crypto analysis to measure whether the current price of a crypto is overvalued or undervalued compared to its historical average.

Let's break it down into simpler terms:

MVRV Ratio: The MVRV ratio stands for Market Value to Realized Value ratio. It compares the current market price of a crypto to the average price at which coins were last moved on the blockchain. It helps us understand if holders are in profit or loss.

Historical Average: An historical average is the average MVRV ratio calculated over a specific period, such as 30 days or 365 days.

Z-Score: The Z-Score measures how many standard deviations the current MVRV ratio is away from the historical average.

Simply… It tells us how extreme or unusual the current market situation is compared to the norm.

A positive Z-Score tells us that the price is higher than the historical average, meaning it might be a good time to sell.

On the other end, a lower Z-Score tells us that the price is lower than the historical average, indicating it might be a good time to buy.

What is the chart telling us now?

We have marked some points on the chart below, that mark out what the MVRV looked like over the past early bull markets…take a look at how it looks now.

Note: Look at how accurate the MVRV score has been to mark out the previous market lows and highs.

This could be the only chart you need!

Crypto Market 📈

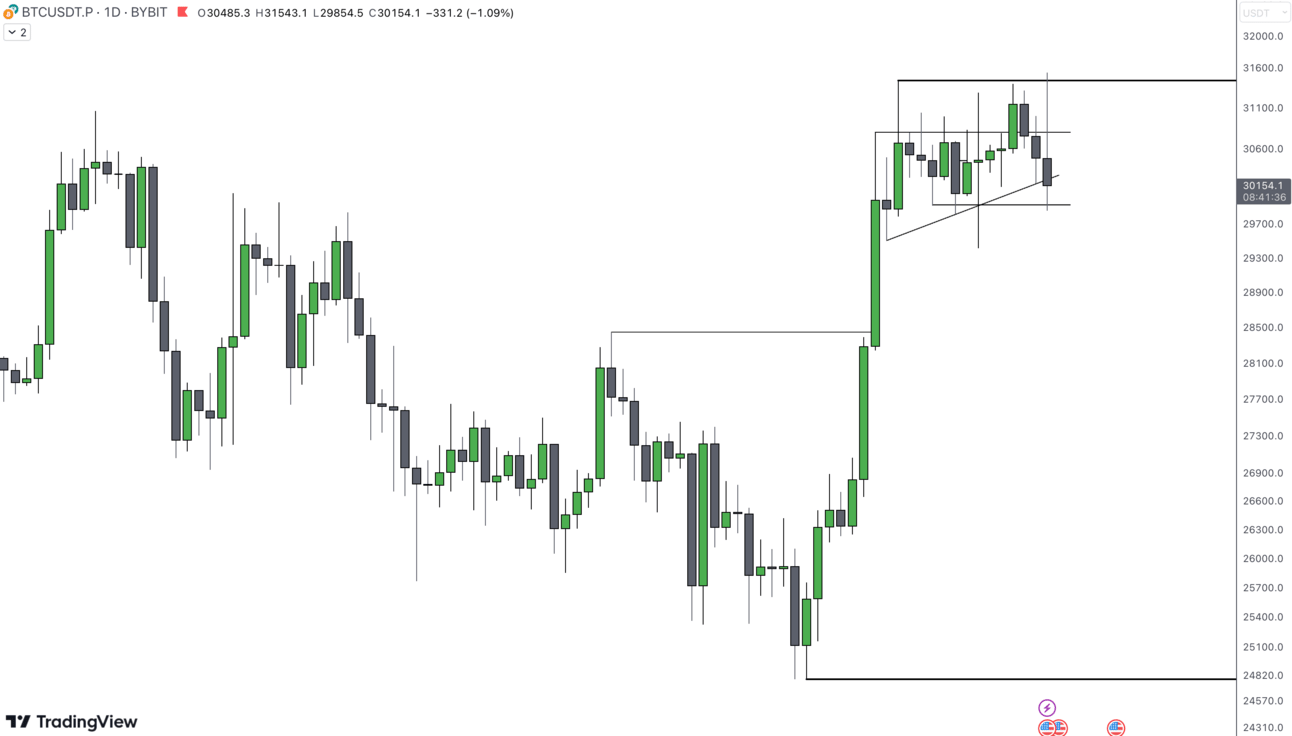

As we mentioned yesterday, the market is looking ready to make some big moves, and the price over the next hours is VERY IMPORTANT.

As you can see on the chart above, the price just spiked briefly over the resistance and “swept the highs”. - This is when the market grabs liquidity that is sitting above recent highs or lows and gives the market “energy” to make a big move, as we see in the next candle.

If we break below the support of the range, BTC is in for a really rough ride down $27k.

The Daily candle, shown on the chart above, is probably the scariest thing on the charts right now, with a very bearish-looking Doji candle.

A Doji is when you have a long wick and a small body candle. The psychology behind this is that the bulls TRIED to push the price to the upside and they ran out of steam and the bears took control of the market.

TradFi Market Outlook 🧐

The US labour market stayed strong in June, with the number of new jobs significantly beating expectations. This means more jobs are coming on the market, and unemployment is heading downnnn.

In fact, it's the largest monthly growth since July 2022.

Interestingly, this significant jump in payrolls took place despite the Federal Reserve's consistent efforts over a year to raise interest rates, largely to bring down the job market where there are almost two job vacancies for every job seeker.

Thats not a bad gig for those in the US huh?

This strong jobs data means that investors believe that the chances of another interest rate hike by the Fed at their next meeting on July 26th, with the probability spiking to 92% this morning!!

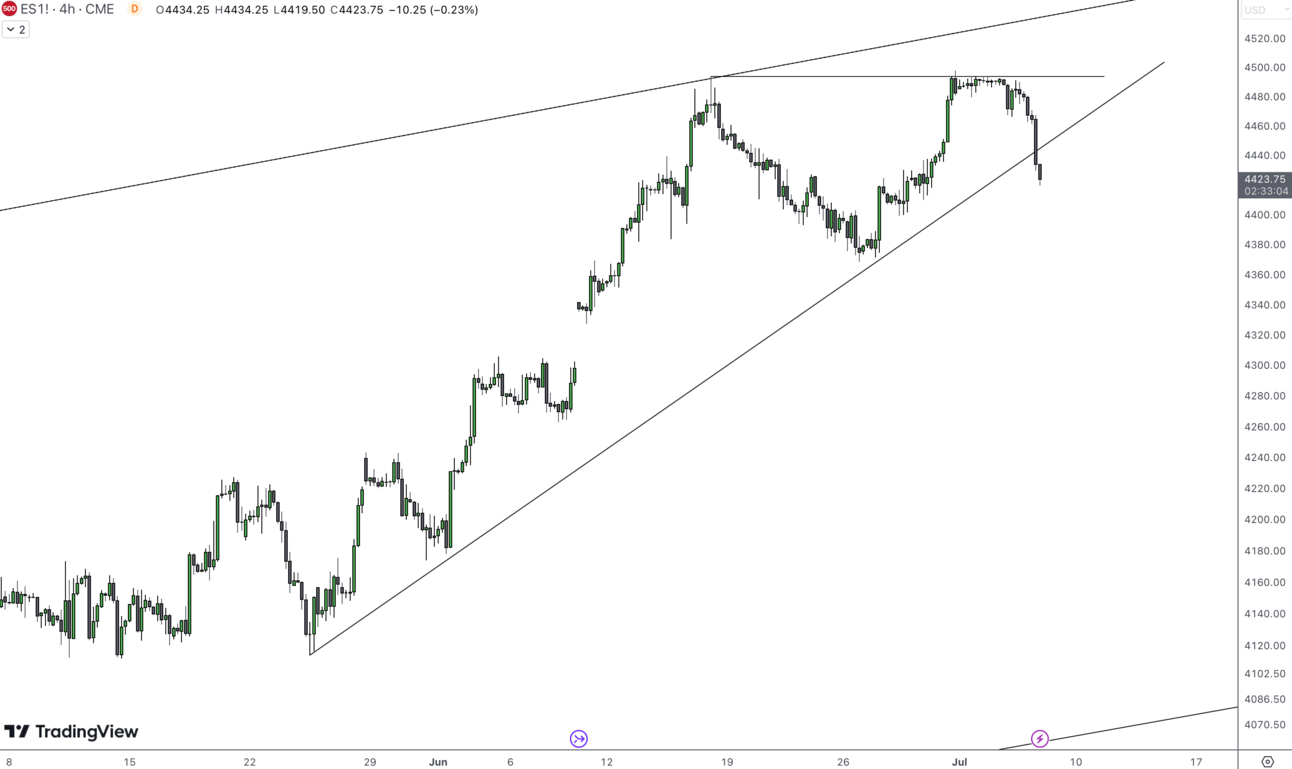

Equity Technicals! 📈

Looking at the 4h chart of the S&P500, the index recently broke below a rising trend line formed at the end of May. This free fall is contributing to what we see in the crypto markets today, if we break the support shown on the chart below, both markets are in for a hard time. (its not looking good right now)

Crypto Word of the Day - Whales 🐳

Today's word is "whales," a term commonly used to describe a veryyyy specific group of crypto investors.

In the crypto community, whales are investors who possess a ALOT of any certain crypto. These are the big players who hold substantial wealth and have the ability to impact the market due to their large holdings.

The term "whale” comes from the massive size and influence of these investors, just like the immense size of these majestic creatures in the ocean.

Whales have the potential to sway the market by buying or selling large quantities of crypto, causing significant price fluctuations. Their actions can trigger cascading effects, leading to a domino effect on smaller traders and investors.

Because of this, many market participants keep a close eye on whale activity as it can provide insights into market trends and potential price movements.

So, the next time you hear someone mentioning whales in the context of finance, you'll know they are referring to these influential players who have the power to make waves in the market.