- Cipher Digest

- Posts

- BlackRock ETF, USDT Crashes, Why the Bears are Back + More | Cipher Digest.

BlackRock ETF, USDT Crashes, Why the Bears are Back + More | Cipher Digest.

BlackRock Aims to Shake Up Crypto with Bitcoin ETF, USDT Stability Concerns Rise, and Market Trends Signal a Bumpy Ride Ahead

Good Afternoon Everyone, hope you’ve had a good week so far.

Cipher is back and here to comfort you in these depressing markets, just like a 1L tub of ice cream after a breakup.

In Todays Digest:

The Latest Breaking News 📣

BlackRock Filing Crypto ETF 🚨

USDT De-Pegs?! 🐻

Chart of the Day 📈

BTC Breakdown 📊

WHY the market has been dropping! 🥲

Cardano Chart Breakdown 🤖

The Latest Breaking News 📣

🚨BlackRock Filing Crypto ETF 🚨

Exciting news, folks!

BlackRock, a big-shot investment company with a whopping $9 trillion in assets, is getting ready to hop on the Bitcoin train. They're planning to file for a Bitcoin exchange-traded fund (ETF), which is like an investment fund you can trade on stock exchanges.

If approved, this could give regular investors, like you and me, a legit way to get in on the Bitcoin action.

VERY BULLISH 🐂

Now, there's still some uncertainty about what kind of ETF it will be. Will it track the actual Bitcoin prices (spot ETF) or be based on Bitcoin futures contracts?

The U.S. Securities and Exchange Commission (SEC) has been a bit hesitant about approving spot Bitcoin ETFs so far. But hey, they've given the green light to a few futures-based ones, so who knows?

BREAKING: The world’s largest asset manager BlackRock is close to filing for a #Bitcoin ETF - CoinDesk

— Bitcoin Magazine (@BitcoinMagazine)

1:52 PM • Jun 15, 2023

USDT De-Pegs?! 🐻

There's been some trouble in stablecoin land, and it's got people all worked up. You see, USDT, the big dog of stablecoins, has strayed a bit from its usual value, and folks are starting to worry.

Been mostly in USDT for the last weeks.

Then there is Binance FUD and I move USDT out to get peace of mind.

Now a small USDT depeg, and you have to monitor the situation again.

I'm tired, boss.

— Route 2 FI (@Route2FI)

7:47 AM • Jun 15, 2023

Here's what went down:

The popular 3Pool on Curve, where people trade stablecoins, got hit with a flood of USDT sellers. That's a sign that traders are ditching USDT and grabbing other stablecoins instead. This messed up the balance, which is supposed to be an even 33.33% for each stablecoin in the pool (USDT, USDC, and DAI).

And as a result, USDT's value started deviating from its usual $1 mark.

Tether, the company behind USDT, had been making a comeback in the stablecoin market lately, especially after the whole banking crisis that made investors flee from USDC. USDT reached a peak of around $84 billion, so you can imagine why folks are freaking out about a potential de-pegging event.

That would be a real DISASTER for the economy!

Earlier this year, when USDC also had a de-pegging scare, regulators started paying closer attention to the stablecoin world. And if another similar event happens now, when some big-name crypto players are already under intense scrutiny, it's going to make things even worse.

But hold on a sec! Crypto experts are saying that there hasn't actually been a de-pegging at all. They point out that a stablecoin's peg isn't determined by its price on an exchange but by whether you can redeem it 1:1 directly from the source. So maybe we're all getting worked up over nothing.

Paolo Ardoino, the Chief Technical Officer of Tether, took to Twitter to reassure everyone:

Markets are edgy in these days, so it's easy for attackers to capitalize on this general sentiment.

But at Tether we're ready as always. Let them come.

We're ready to redeem any amount.— Paolo Ardoino 🍐 (@paoloardoino)

6:02 AM • Jun 15, 2023

As for who's behind this USDT dump, it's still a mystery. But word on the street is that a big player called CZSamSun borrowed a whopping 31.5 million USDT and traded it for USDC.

What do people gain from this sh*t?

Chart of the Day 📈

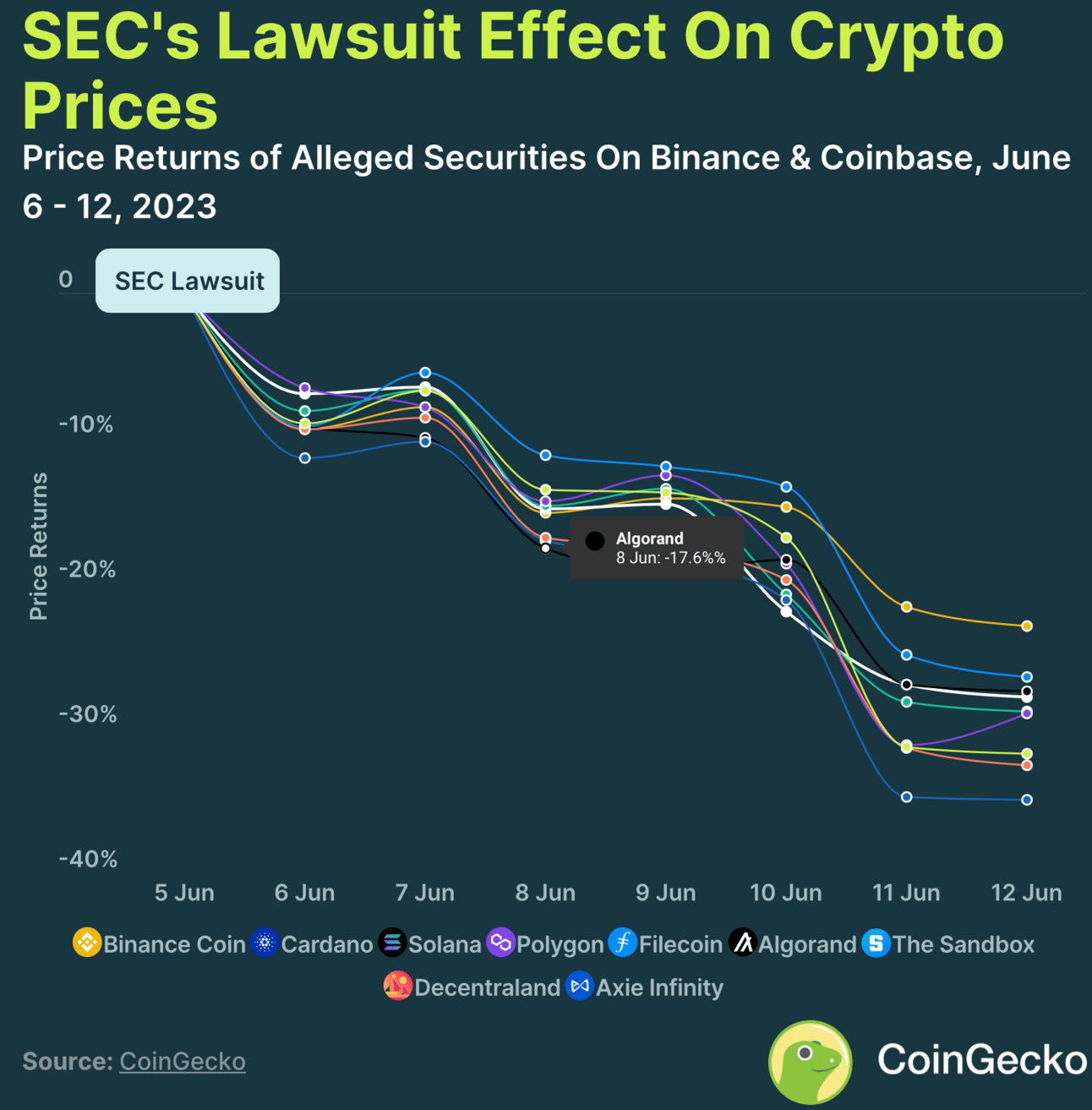

The chart below shows the huge impact that the SEC has had on the crypto market as a whole. June has been a slowwww and draggy month with prices heading steadily downwards.

As mentioned in our BTC update below, the market currently rests on a last line of support, expecting a big move across the market this week.

BTC Breakdown 📊

BTC has now broken down and held right at the support of the bull flag which we have been keeping an eye on. In the image below, you can see that price has halted and consolidated on the support, as mentioned yesterday we would look for a 4H candle close below the support, for shorting opportunities.

A 4H candle closure above $25.7k and we push to $28k.

Open interest (that's how many contracts are still active) has shot up by a mind-blowing $450 million, and trading volume has gone wild with a whopping 110% surge in the last 24 hours.

WHAT ARE YOU GUYS DOING?!

You savage crypto traders are building up the market for a huge move incoming, absolutely wild.

WHY the market has been dropping! 🥲

The Federal Reserve has decided to leave rates unchanged in the range of 5.00-5.25%, as expected.

“The U.S. banking system is sound and resilient”.

“Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain.”

“The Committee remains highly attentive to inflation risks.”

Looking at the recent dot plot, we can see that the Fed pivoted to a hawkish pause in rates as the projected terminal rate increased to 5.6% from 5.1% in March. This implies two additional rate hikes within the 2023 fiscal year.

For May 2023, we note that the median rate projected for the close of 2023 stands at 5.6%, marking a rise from March.

In 2024, the target rate is projected at 4.6%. This upward trend continues into 2025, with the median target rate predicted to be at 3.4%, in comparison to the previously projected 3.1% in March.

This data NOT ONLY suggests a steady increase in rate expectations but also illuminates the Federal Reserve's ongoing shift towards a more hawkish monetary policy.

THIS IS WHY THE MARKET HAS BEEN DROPPING.

Some people just looked at the Fed not increasing the market, as bullish, but you need to dive deeper into the fundamentals, that’s why Cipher is here for you.

Crypto Spotlight - Cardano (ADA) 🧐

ADA leads the decline in major cryptos as BTC drops below $25K.

Regulatory uncertainties brought by the SEC lawsuit has been the story behind the selling pressure contributing to the downward trend.

ADA/USDT - ADA reaches lows last seen in Jan '21 as the downtrend continues. On the weekly chart, a more significant 42% fall in price can be seen which is drawn from the last weekly candle opening on 5th June (day of SEC lawsuit).

As this sharp downtrend continues, we approach closer to areas of support last visited in 2020, which is where price paused from Jul-Dec '20 before huge buying pressure kicked in.