- Cipher Digest

- Posts

- BTC to $120k?!, Tuesday Trades & Technicals! | Cipher Digest

BTC to $120k?!, Tuesday Trades & Technicals! | Cipher Digest

It’s time to turn up this Tuesday with another daily market review.

Good Afternoon, Cipher is the only newsletter that is even better than the perfect ketchup-to-fry ratio.

Let’s see whats going on…

In Todays Digest:

Latest In Web3 🚨

News of Today 📰

Crypto Market Outlook 📊

The Macro Situation In 2023 (So Far) 🌚

Today’s Crypto PRO Tip 💸

Latest In Web3 🚨

HK government will introduce stablecoin regulation next year

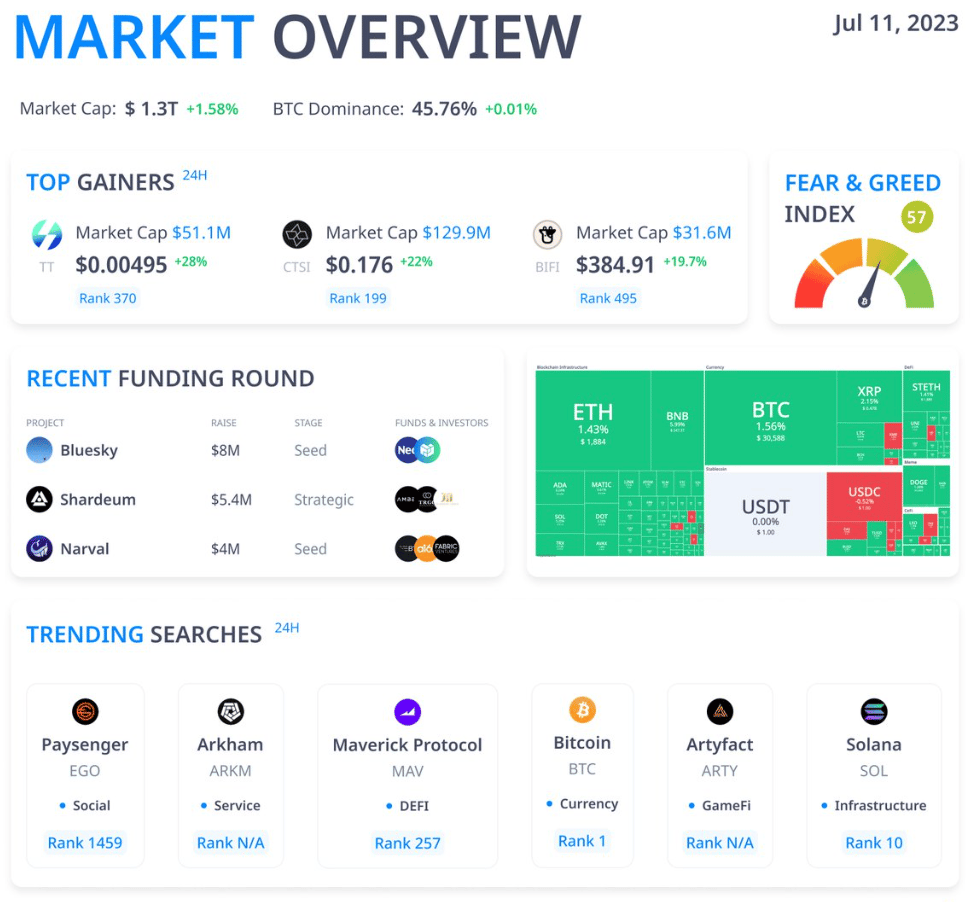

Arkham has apparently been doxxing users for months

UK shuts down 26 crypto ATMs following coordinated investigation

Dubai takes enforcement action against Middle East crypto exchange BitOasis

Tuesday Technicals 📈

Bitcoin Bollinger Bands are the tightest on the daily since the start of 2023 The last time they were this tight we had a 40% move up.

Another 40% higher from here would be $42,000…

Rome Wasn’t Built in a Day 🇮🇹

I have seen a NUMBER of people all saying that this year has been something which is great for the market and that all crypto holders are up 90% since the start of the year.

The market is not as easy as that…

Firstly, the market has NOT been a consistent climb up. Instead, there’s been a lot of choppy and messy price action making it hard for investors to actually maintain the conviction to hold.

Secondly… more than 90% of ALL THE GAINS seen this year, came from….

9 DAYS

We are past the half way mark of the year, thats 6 months, 24 weeks and 191 days… for just 9 days of “real” positive price movement.

Don’t let ANYONE tell you that the market is easy or simple to be up from the start of the year. Price has been horrible and choppy. Good Job making it this far.

Tuesdays Trading Ideas 💸

Looking at the BTC chart, we can see that price is STILL consolidating in this tight price range between $30,000 and $30,700.

But that’s boring…

Trading in choppy and inconsistent ranges is NOT the right thing to do. With this kind of price action, and ALSO very low volume, the market is very unpredictable.

We don’t trade in conditions like these since there are no high-probability set ups, in this type of market.

THAT BEING SAID…

We do anticipate a big move coming in soon, the moment we close past the below support or resistance.

In terms of probability, I do expect the price to make a fast and fuelled move to the downside, down to the green box.

This is where I would look to enter a long.

Past this, I would then look for prices to extend up and past the market highs, up to $33,600.

Here I would short back down to $31,500.

We are anticipating more choppy price action ahead until the CPI figure tomorrow morning. If the US dollar keeps dropping further, then it’s possible that BTC breaks ABOVE the yearly highs.

Crypto Market Analysis 📊

Bitcoin's value has a history of going through cycles of ups and downs, with periods of price stability in between.

Currently, we are in one of these stable phases where the price is moving sideways. This can create uncertainty for investors who are unsure if the price will rise or fall significantly.

Looking back at past cycles, we can see that during the 2013-2016 cycle, the price of Bitcoin faced resistance at around $425. Similarly, in the 2018-2019 cycle, it settled at around $6,500.

Currently, the market seems to be consolidating once again around the $30,000 mark. This situation presents an interesting scenario for Bitcoin as we wait to see if it can surpass this resistance or if it will be influenced by it.

Standard Chartered revises bitcoin price target to $120,000

— The Block (@TheBlock__)

8:48 PM • Jul 10, 2023

According to a recent report by Standard Chartered, a global bank, Bitcoin's price could potentially reach $50,000 by the end of this year and even climb to $120,000 in the following year. This aligns with the prediction made by Matrixport, a crypto financial services platform, which forecasts a value of $125,000 for Bitcoin by 2024.

Standard Chartered also highlighted the important role that Bitcoin miners could play in driving this potential price surge. The bank's foreign exchange analyst, Geoff Kendrick, explained that as profitability for each Bitcoin mined improves, miners can sell fewer Bitcoins while still maintaining their cash inflows. This reduction in the net supply of Bitcoin could potentially drive prices upward.

TradFi Update 📰

JUST IN: The 30 year mortgage rate has hit a new decade high at 7.38%, up 23 bps since last week, per BankRate

— unusual_whales (@unusual_whales)

10:47 PM • Jul 10, 2023

Coincidence or Conspiracy👁️

Last Bitcoin ETF decision deadline: 19/03/2024

Bitcoin halving estimate: 16/04/2024

Everyone by now, knows that the BTC market cycles are largely based around the time of the halving, now when we look at the next big halving prediction date and the date of the deadline for the BTC ETFs, they are quitteee close.

If that doesn’t signal a super rampage bull market, then I don’t know what does.

What is the Halving?

The Bitcoin halving is an important event that occurs approximately every 4 years as part of the Bitcoin protocol. It is programmed into the system to control the supply of new Bitcoins being generated and to ensure that the total supply of Bitcoin remains finite.

Here's a simplified explanation of how BTC halving works and its impact:

Bitcoin Supply: The total supply of Bitcoin is limited to 21 million coins. This scarcity is one of the factors that contribute to Bitcoin's value.

Mining: Bitcoin miners are individuals or entities that use powerful computers to solve complex mathematical problems. When a problem is solved, a new block of transactions is added to the blockchain, and miners are rewarded with newly minted Bitcoins. This process is called mining.

Block Reward: Initially, when Bitcoin was launched in 2009, the block reward was set at 50 Bitcoins per block. However, to control the rate of new Bitcoin creation, the protocol includes a mechanism known as "halving."

Halving: Every 210,000 blocks (approximately four years), the block reward is halved. So, after the first halving in 2012, the block reward reduced from 50 to 25 Bitcoins. After the second halving in 2016, it further decreased to 12.5 Bitcoins. The most recent halving occurred in May 2020, reducing the block reward to 6.25 Bitcoins.

Impact on Supply: Halving reduces the rate at which new Bitcoins are introduced into circulation. This slowing supply growth acts as a counterbalance to inflation and ensures that the supply remains limited. As a result, the rate at which new Bitcoins are mined gradually decreases over time.

Market Cycles: Bitcoin halving has historically had a significant impact on the market cycles and price of Bitcoin. The reduction in the rate of new supply, combined with growing demand, usually leads to increased scarcity and upward price pressure.

Tweet of the Day🐦

Why am I bullish crypto?

Easy.

I have no marketable skills, am a terrible employee, and have completely isolated myself from the rest of the world.

— Man-Goh (@Inga_no)

1:36 PM • Jul 10, 2023