- Cipher Digest

- Posts

- BTC is lowkey boring, Major Market News, Price Prediction + more | Cipher Digest

BTC is lowkey boring, Major Market News, Price Prediction + more | Cipher Digest

Jump in to see what we expect from the BTC price, SP500 and more!

Mid-week already, BTC is back to being boring, the market isn’t really moving BUT we still have a lot to cover!!

In Todays Digest:

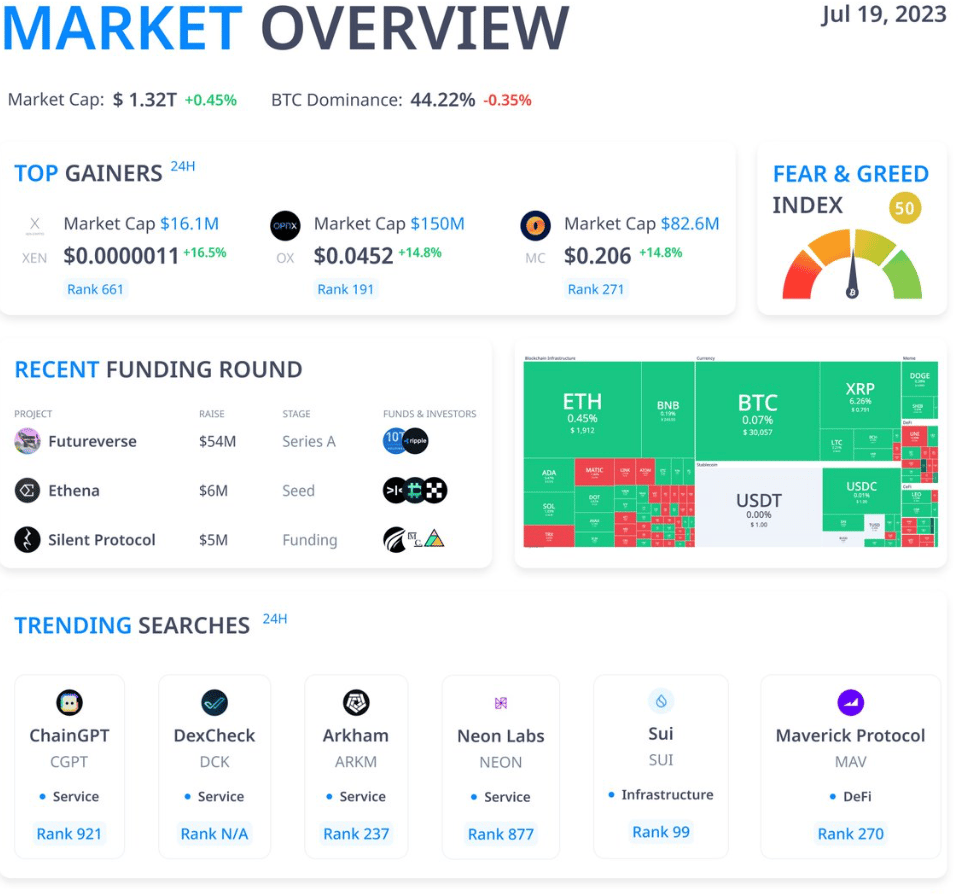

Market Overview 🌚

Latest in Web3 🚨

Chart of the Day 👇

Crypto Market Outlook 📊

TradFi Market Outlook 🧐

Tweet of the Day 🐦

Latest in Web3 🚨

US lawmakers call on SEC to stop regulatory assault on crypto

CEO of EminiFX was sentenced to 9 years in prison for the scam scheme

Polychain Capital raises $200 million for the fourth fund

Hong Kong banks resist despite cryptocurrency boom

StarkNet’s TVL surpasses $100 million with record TPS and reduced latency

U.S. Presidential Candidate Robert F. Kennedy Jr. Proposes Bold Plan to Back Dollar With Bitcoin, End Bitcoin Taxes

JUST IN: 🇺🇸 Presidential candidate Robert F. Kennedy Jr. announces plan to back the US dollar with #Bitcoin if elected in 2024.

— Watcher.Guru (@WatcherGuru)

3:24 AM • Jul 19, 2023

A dormant pre-mine address containing 61.2k ETH ($116m) has just been activated after 8 years

78% of Americans anticipate Bitcoin will hit a new all-time high, according to a CryptoVantage survey.

Vitalik Buterin says Account abstraction is a big deal as Explains How Ethereum Plans to Make Crypto Wallets as Simple as Email

US Congressman, Ritchie Torres, Calls Gary Gensler: "Stop Attacking Cryptocurrencies"

JUST IN: 🇺🇸 SEC Chair Gary Gensler says he's "disappointed" the court ruled $XRP is not a security.

— Watcher.Guru (@WatcherGuru)

6:16 PM • Jul 17, 2023

Bitcoin to $1.5 Million? Cathie Wood Says Her Confidence Has Increased

Chart of the Day 📊

The supply last active shows us how many people are “moving” their BTC. If there is a lot of movement, this can imply there are people getting ready to sell as they move coins onto exchanges or into other wallets.

If the number of people in each category is increasing then this means that people are accumulating and HODLING. This is a good sign since it means that there are fewer Bitcoins for sale and as demand increases, price will too.

Now just take a look at what’s been happening with the supply Last active:

Wow!

All-time high in all categories once again for #Bitcoin supply last active.

1+ Year = 69.106%

2+ Years = 55.689%

3+ years= 40.123%

5+ years= 29.092%— James V. Straten (@jimmyvs24)

8:41 AM • Jul 17, 2023

Multi-year view:

Bitcoin is no longer in a period of capitulation

— Will Clemente (@WClementeIII)

1:17 PM • Jul 19, 2023

Crypto Market Outlook 📊

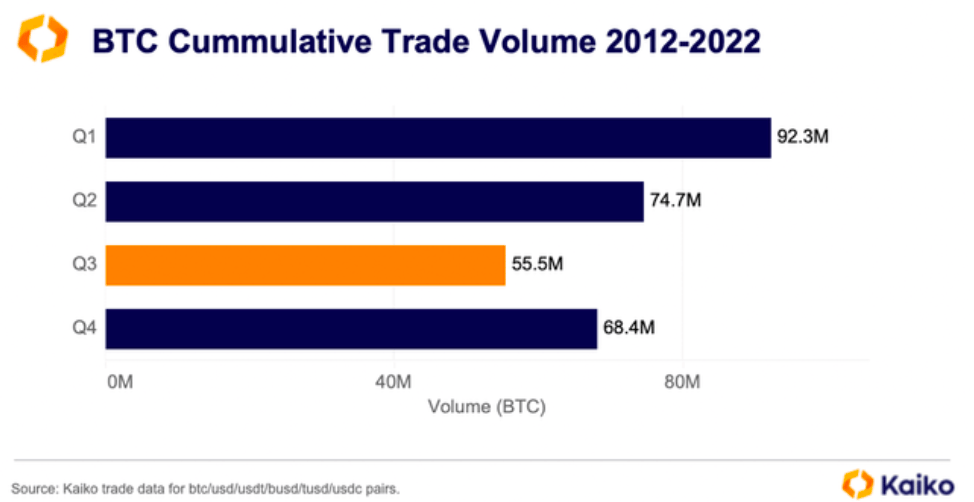

When looking into the mean (average) performance from the 3rd Q of 2012 through to 2022, it can be observed that this quarter historically registers the least volume, and by a significant difference at that.

The total trade volume of Bitcoin (BTC) during this period in Q3 is notably lower by a staggering 13 million BTC compared to the subsequent lowest quarter.

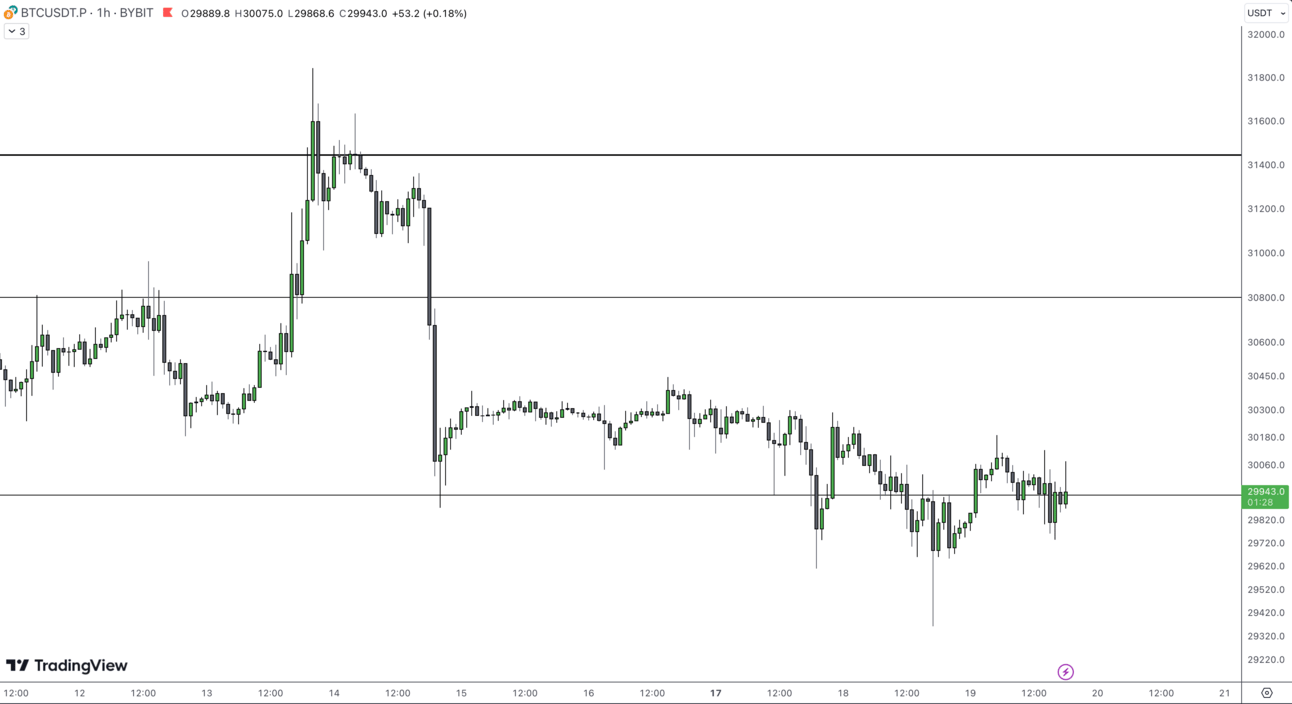

BTC price has now re-entered the channel of dullness (as I have begun to call it), where we have spent WEEKS now.

Since the 26th of June to be precise.

After a brief fall down to $29k, which was expected, we believe that there is huge amount of liquidity resting there, causing the price to pump back up. But not enough for it to cause the price to break above the channel.

This is all while the price has MANY reasons to move.

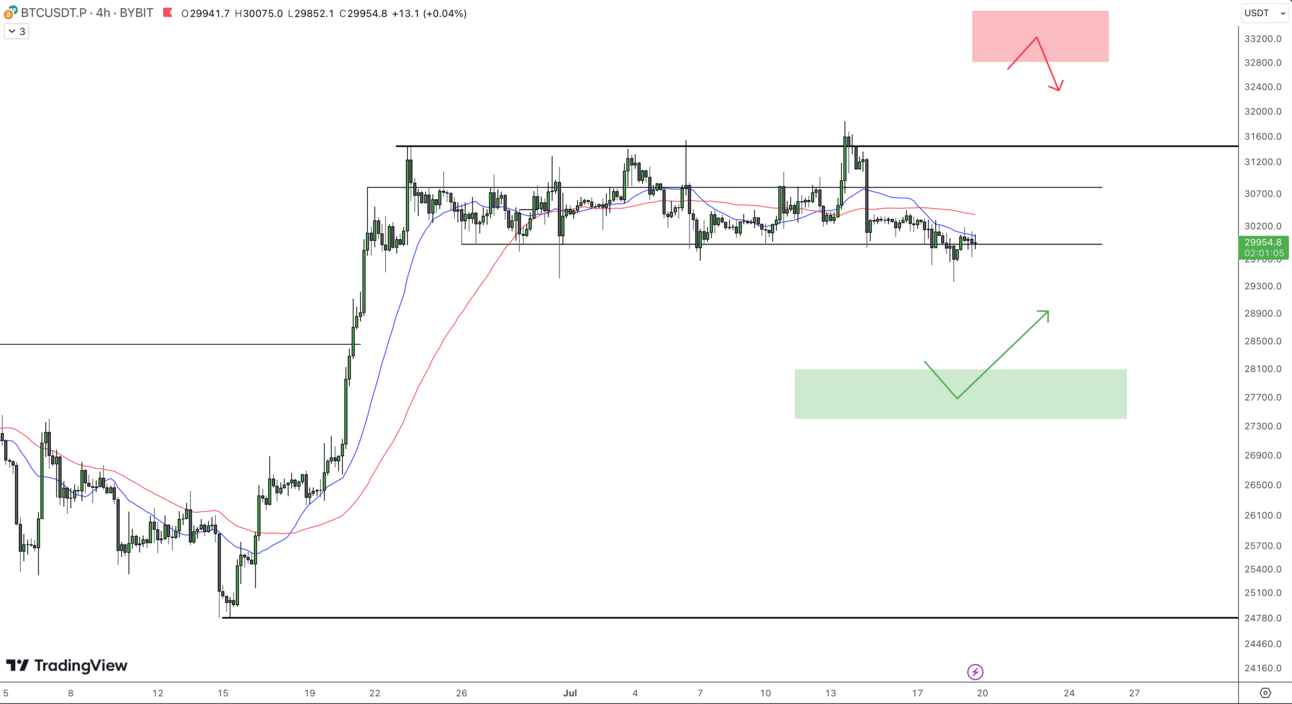

On the larger, 4H timeframe, we can see very clearly that the price has been pushed down by the resistance created by the 20 Moving Average (MA). With no daily close above it in the last 5 days.

More recently we can see the price being suppressed and tightened between the horizontal support and 20 MA.

TradFi Market Outlook 🧐

We know these times are hard…

Despite the markets pumping this year which is making most headlines, we still understand that the current economy is really tough out there for the average Joe.

Just take a look at the housing market for example:

1. Homes on the market at a record low of 1.3M

2. 53% of homes require an income of $125K+ to afford

3. Average 30 year mortgage at 7%

4. Mortgage demand lowest since 1995

5. Median rent payment hits $2000/mo This is the least affordable housing market in history.

But all this, while the stock market is showing incredibly bullish signs so far this year? Something seems strange right? It both does and doesn’t feel like a recession is taking place.

In case you are wondering how strong this stock market is:

The SP500 did not have a single red hourly candlestick today aside from the last hour of the day.

That red candlestick was a mere 4 point drop, or 0.09%.

The S&P 500 is up 730 POINTS since January 1st.

The Nasdaq is up 3,966 POINTS since January 1st.

That's a 38% gain in the world's largest tech index.

Simply incredible.

Not only this but things should start to pick up more into next week as the Fed meeting approaches and earnings season kicks off.

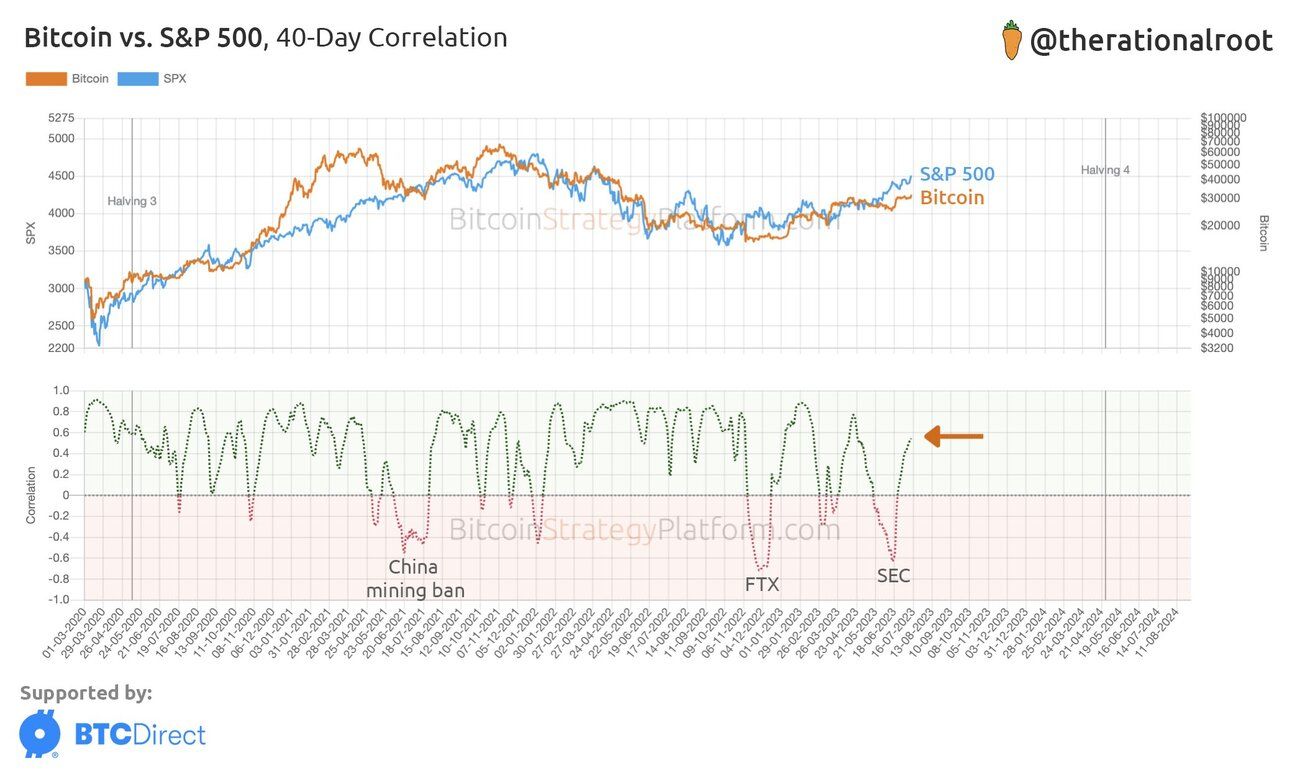

This being said, it’s important we keep an eye on the SP500 since the correlation to BTC is now in the positive again.

Recession Soon Come?

Goldman Sachs has updated its forecast for the possibility of a U.S. recession within the next year. They have reduced the likelihood from 25% to 20%, following a review of recently released economic data that has outperformed expectations. The revision was announced in a research report published late Monday.

“The main reason for our cut is that the recent data have reinforced our confidence that bringing inflation down to an acceptable level will not require a recession”

“But the easing in financial conditions, the rebound in the housing market, and the ongoing boom in factory building all suggest that the U.S. economy will continue to grow, albeit at a below-trend pace”

If you’re like the rest of us then you will also understand that these projections are no longer accurate representations of the state of living, like we mentioned earlier.

Tweet of the Day 🐦

#Bitcoin - whats next ?

In last weeks Sunday report it was mentioned that 3 key scenarios were expected to happen:

- Close weekly above WMA200 ✅

- Continue in sideway range ✅

- Grab liquidity ✅My theory remains unchaged, and confirming the impressive strenght of BTC in… twitter.com/i/web/status/1…

— Doctor Profit 🇨🇭 (@DrProfitCrypto)

5:51 PM • Jul 16, 2023