- Cipher Digest

- Posts

- BTC threatens breakdown, Weekly News Roundup, Crypto Analysis | Cipher Digest

BTC threatens breakdown, Weekly News Roundup, Crypto Analysis | Cipher Digest

Happy Monday! I hope you’ve had a good weekend and are ready for another week of work! :’)

Happy Monday! I hope you’ve had a good weekend and are ready for another week of work! :’)

In Todays Digest:

Last Week in Web3 🚨

Crypto Market Analysis 📈

TradFi Market Outlook 🧐

What to Watch This Week 👀👀

Tweet of the Day 🐦

Last Week in Web3 🚨

Ripple partially wins case against SEC, as judge rules XRP is not a security.

JUST IN: 🇺🇸 SEC Chair Gary Gensler says he's "disappointed" the court ruled $XRP is not a security.

— Watcher.Guru (@WatcherGuru)

6:16 PM • Jul 17, 2023

Standard Chartered boosts 2024 Bitcoin forecast to $120,000.

SEC formally accepts BlackRock’s Bitcoin ETF application – CEO Larry Fink states cryptocurrencies set to “transcend any one currency.”

Coinbase shares skyrocket following SEC v Ripple ruling, were already up 50% prior to the decision – since Coinbase was sued by SEC a month ago.

Binance’s BNB Chain set to undergo hard fork upgrade on Wednesday – exchange recently laid off 1.000+ employees globally.

JUST IN: Binance officially integrates #Bitcoin Lightning Network.

— Watcher.Guru (@WatcherGuru)

3:19 AM • Jul 17, 2023

Former Celsius CEO Alex Mashinsky arrested, as company agrees to pay $4.7 billion in settlements for the FTC.

Ethereum co-founder Vitalik Buterin wants Bitcoin developers to experiment with Layer 2 solutions just like Ethereum does.

DeFi borrower uses luxury watch-backed NFT as collateral for a loan.

US 2024 Presidential candidate Ron DeSantis vows to ban CBDCs if elected.

US inflation up by a mere 0.2% in June, cooling for the 12th straight month.

Bank of England Governor Bailey vows to “see the job through” on fighting inflation – urges UK lenders to pass on interest rates to savers as economy shrinks by 0.1%.

What to Watch This Week 👀👀

1. Retail Sales data - Tuesday

2. Building Permit data - Wednesday

3. Existing Home Sales data - Thursday

4. Jobless Claims data - Thursday

6. ~10% of S&P 500 reports earnings

We're 10 days out from the Fed meeting.

Crypto Market Analysis 📈

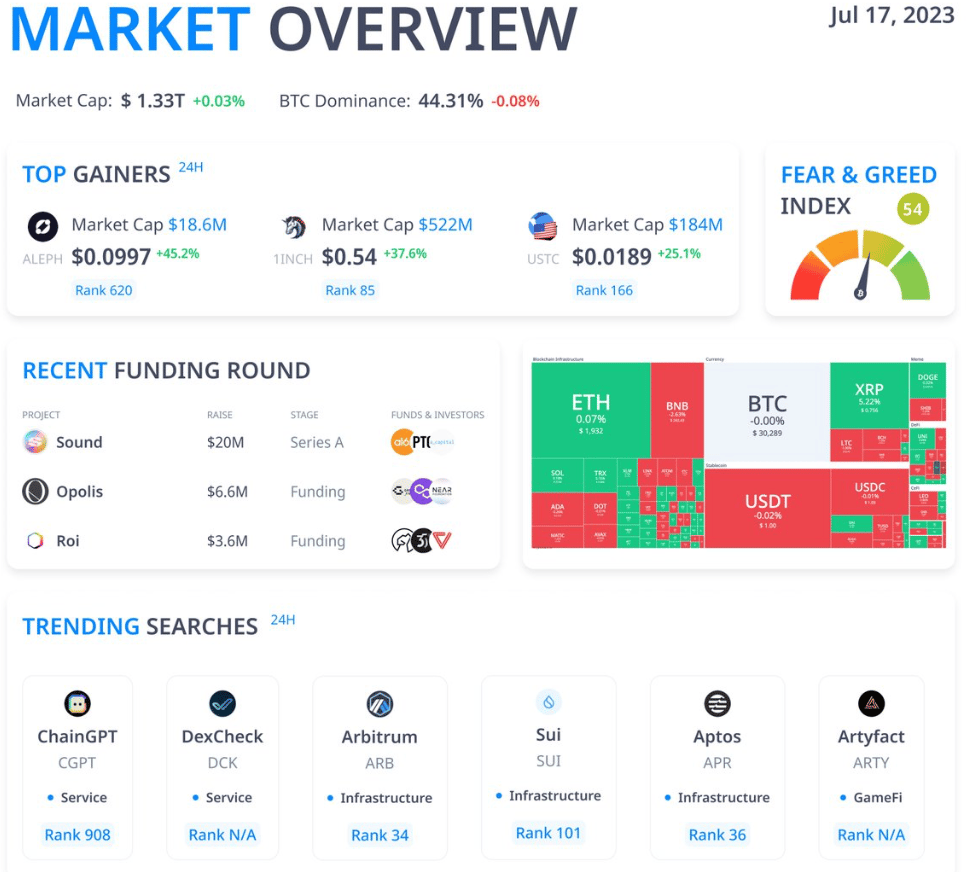

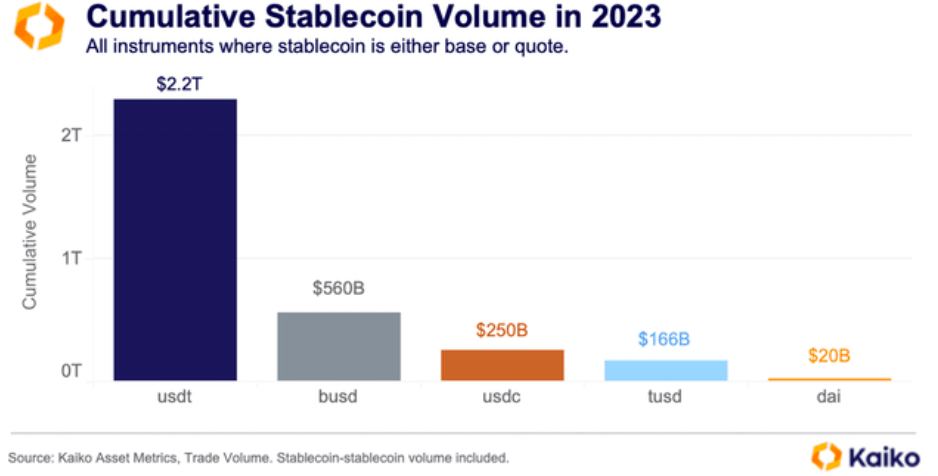

Examining stablecoins for a moment, their combined trading volume in 2023 exceeds $3 trillion, with Tether playing a commanding role.

As it stands, Tether boasts an impressive 70% market share on centralized exchanges.

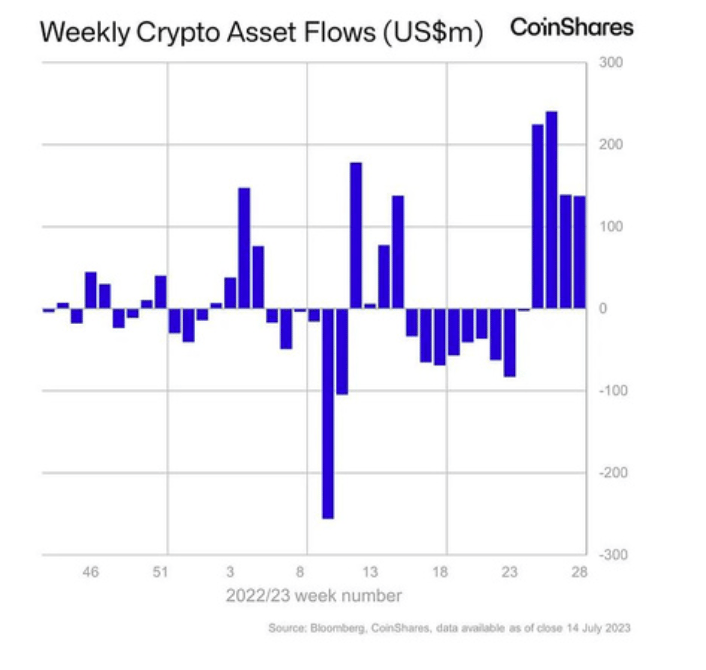

Investments in digital asset products registered an inflow of US$137m in the past week.

Subsequent revisions to the previous weekly data reveal a four-week total of US$742m in inflows, marking the most significant influx of funds since the fourth quarter of 2021.

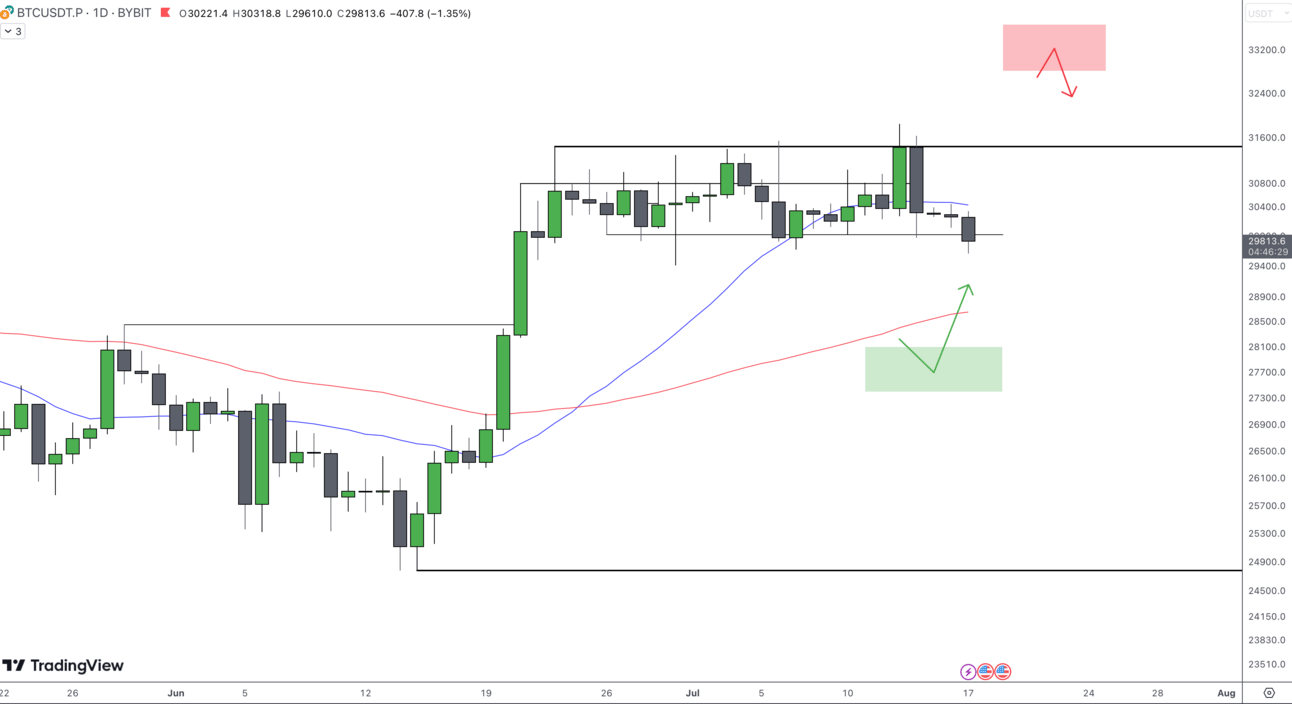

BTCUSDT has pulled back towards the bottom end of the consolidation channel and is looking for a rebound. If prices manage to break above 30,500 then we could expect a rise in prices towards 31,250 and possibly 31,800. A break below 29,900 might trigger bearish implications dragging prices lower towards 29,530 and possibly even lower.

Looking at the daily chart, we can see that prices have traded below their 20-day moving average for 4 consecutive days which hasn’t taken place since the first half of June. The RSI is capped by a declining trend line, indicating an exhaustion of the previous uptrend. If prices break below 29,500, then we might retest the 50-day moving average near 28,500.

XRP, quite unsurprisingly, has shown a HUGE increase in almost every measurable metric. According to data from Kaiko, XRP has now overtaken BTC as the highest-volume asset.

#XRP has surpassed #BTC as the highest volume asset 👀

Since last week's court ruling, 21% of all crypto trade volume has been for XRP.

— Kaiko (@KaikoData)

9:02 AM • Jul 17, 2023

We have also seen an amazing tweet, shown below, which perfectly exemplifies how difficult this market cycle has been. Despite ALL this BTC is still at $30,000.

Not so bad when you think about it…

This #bitcoin cycle:

- War

- Pandemic

- China mining ban

- Luna, Celsius and FTX crash

- Media and SEC FUD

- Bank collapses

- High inflation

- Rate hikes

- RecessionCongrats if you’re still here after the toughest bear market ever. Now the stage is set for the halving!🚀

— Bitcoin for Freedom (@BTC_for_Freedom)

10:00 AM • Jul 16, 2023

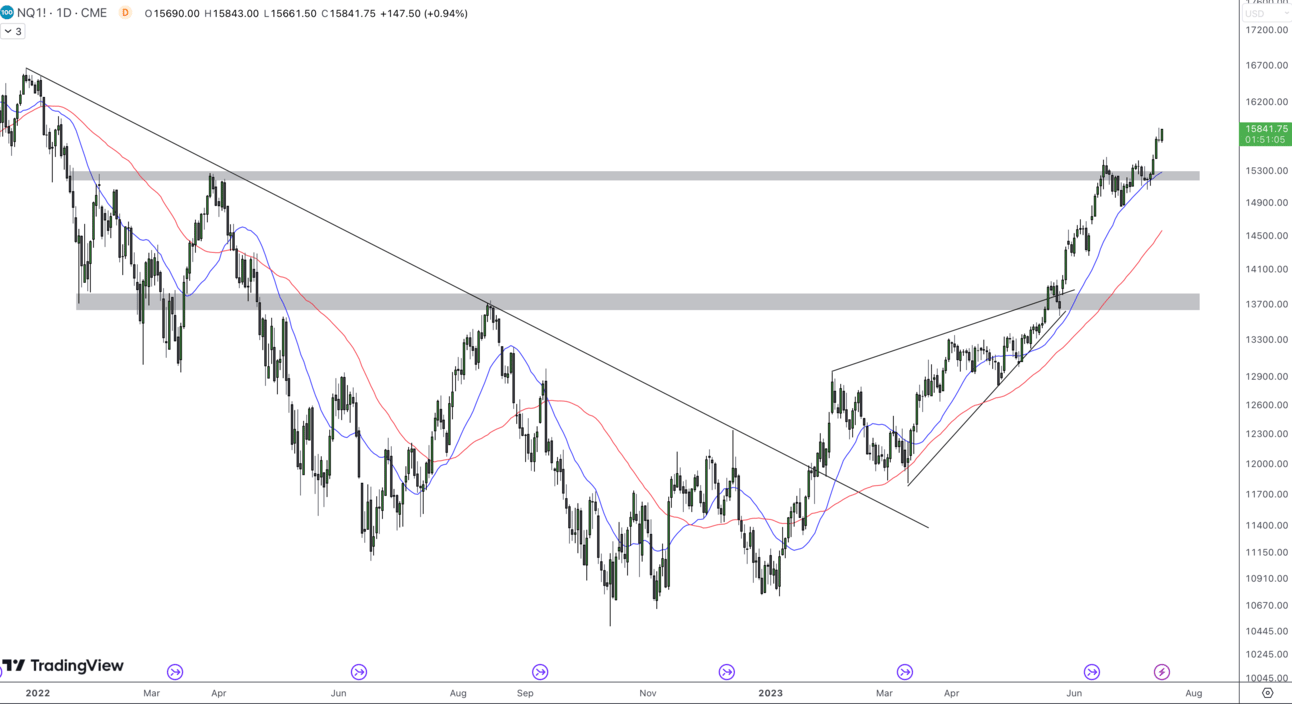

TradFi Market Outlook 🧐

Upon examining China's economic statistics, it was revealed on Sunday evening that the GDP for the second quarter climbed to 6.3%, falling short of the anticipated 7.1%. In June, the unemployment rate among the youth, specifically those aged between 16 and 24, surged to 21.3%, marking a historic high.

Even though China recently lowered its interest rates in an attempt to invigorate its economy, Beijing has generally been hesitant to implement more extensive stimulus measures. This caution is particularly noticeable as local government debt continues to escalate.

U.S. equity futures are maintaining a relatively steady position as we commence the week, with a flurry of corporate earnings anticipated. This comes off the back of a successful week for stocks, in which the Dow Jones Industrial Average enjoyed a 2.3% rise, marking its best weekly advancement since March. Similarly, the S&P 500 and Nasdaq Composite increased by 2.4% and 3.3% respectively.

On Wall Street, a degree of apprehension is being felt in anticipation of a potentially disappointing season marked by diminished profits. Analysts are projecting a decline exceeding 7% in S&P 500 earnings compared to the previous year, as per FactSet data.

The possibility of an increase in interest rates later this month is highly anticipated among market players, with the CME Group’s FedWatch tool indicating nearly a 97% probability. This follows a pause in hikes that occurred in June.

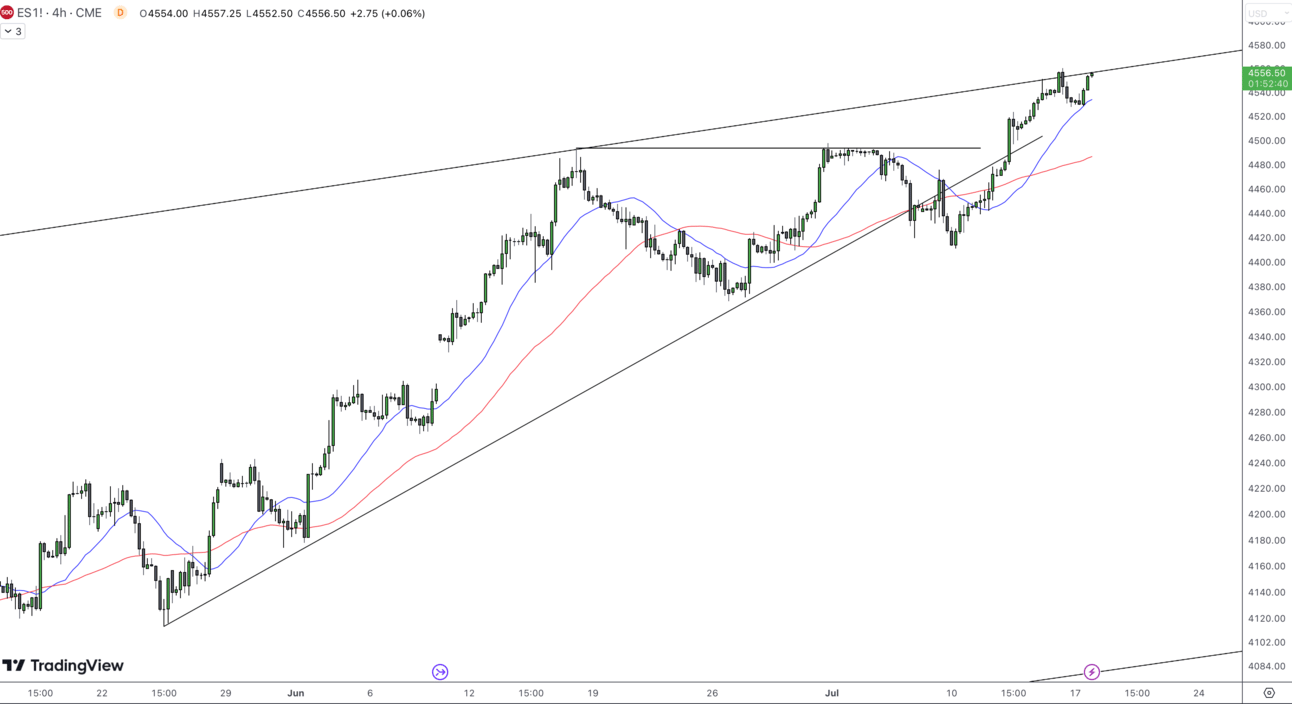

From a chartist point of view, the SP500 is trading within a consolidation channel on an intraday basis. The index recently broke below a rising trend line and also pulled back from the top-end of the channel pattern, advocating for further pressure. If we break below the session lows, we may very well test the support level of 4495. Moving on with the daily chart, we can see that prices made yearly highs however the RSI hasn’t, which leads us to believe that we may be facing a bit of bearish divergence.

Tweet of the Day

Psychology and behavior of crypto traders.

— Coingraph | News (@CoingraphNews)

7:57 PM • Jul 15, 2023