- Cipher Digest

- Posts

- CPI Drops AGAIN, Latest in Web3, Exchange Balances | Cipher Digest

CPI Drops AGAIN, Latest in Web3, Exchange Balances | Cipher Digest

We are now halfway through the week and CPI is down low... finally. This is huge for the market. Let’s take a look at whats coming up for the market.

We are now halfway through the week and CPI is down low… finally. This is huge for the market. Let’s take a look at whats coming up for the market.

In Todays Digest:

Market Overview 🌚

Latest in Web3 🚨

Chart of the Day- Market Cycles 👇

Crypto Market Outlook 📊

TradFi Market Outlook 🧐

Tweet of the Day 🐦

Latest in Web3 🚨

Cboe enters agreement with Coinbase for spot Bitcoin ETFs

Microsoft partners with Axelar to boost integration of Web3

FTX introduces customer claims portal

Celsius files lawsuit against StakeHound over $150 Million token dispute

DOJ arrests senior security engineer for stealing over $9 Million in crypto

The SEC response to Coinbase's first legal defense on July 13th could be important for tokens that have previously been considered securities such as $SOL and SMATIC. Judging from COIN's strong outperformance recently, the likelihood of a positive outcome is hig

BREAKING: 🇺🇸 US inflation falls to 3%, lower than expectations.

— Watcher.Guru (@WatcherGuru)

12:30 PM • Jul 12, 2023

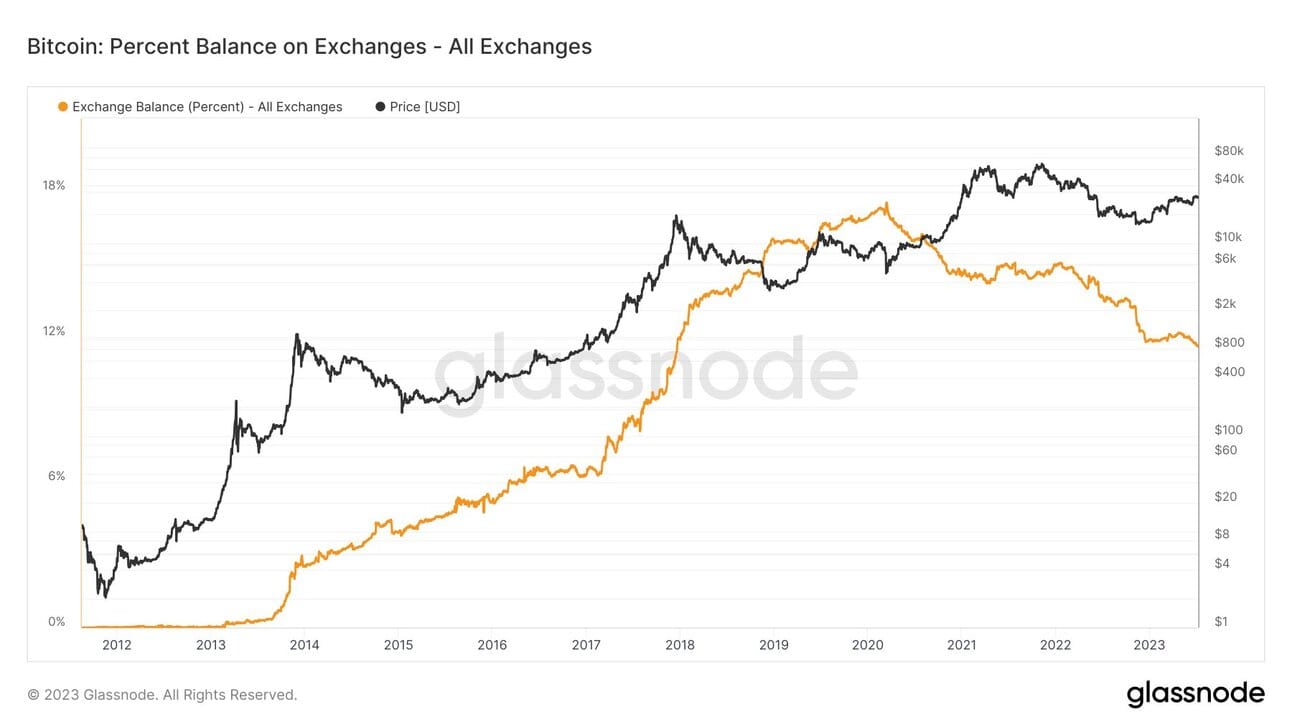

Chart of the Day - Exchange Balances 🎯

Here's the deal: we're currently witnessing a jaw-dropping phenomenon—only 11.5% of the entire Bitcoin supply remains on exchanges, marking the lowest figure we've seen in over five years! 📉📈

But what does this mean?

What's the scoop on this mind-boggling statistic, and how will it affect the crypto price? Well, let me break it down for you in a way that'll make your neurons do the crypto shuffle.

Picture those exchanges as bustling marketplaces, where BTC hangs out, showcasing its digital charm to potential buyers. Now, imagine that with just 11.5% of the BTC supply available on these platforms, it's as if the markets have become the trendiest VIP clubs in town, with the entrance line stretching around the block! 🎉🕺

So, what's causing this mad rush to get Bitcoin off the exchanges and into the hands of HODLers?

Well, my savvy friends, it's a sign—an indication that the crypto community is tightening its grip on their beloved BTC. They're going full-on HODL mode, clutching their digital assets as tightly as a collector holds a rare, autographed baseball card.

And what happens when the supply of something becomes scarce?

It's simple economics, folks—the demand shoots through the roof like a rocket powered by sheer enthusiasm! With BTC becoming scarcer on exchanges, those who crave a piece of the decentralized action will have to roll up their sleeves and get their game faces on. Picture traders sprinting towards their trading terminals, armed with determination, and ready to seize every opportunity to grab their share of the elusive Bitcoin pie.

The movement of BTC off exchanges also speaks volumes about the unwavering faith in the future of this digital marvel. It's like a vote of confidence, a resounding "yes" echoing through the blockchain corridors. People believe in BTC’s long-term potential and are treating it like the crown jewel in their investment portfolio. It's the backbone of their financial fortress, standing tall and resilient amidst the crypto chaos. 💎🏰

In March 2020 Coinbase held over 1,000,000 BTC.

This has now dropped to 439,000 BTC.

The exchanges are being drained.

#Bitcoin is on the cusp of true price discovery.

— Joe Burnett (🔑)³ (@IIICapital)

1:47 PM • Jul 11, 2023

Banks Lie to You

2 headlines.

7 months apart.

#Bitcoin

— Benjamin Cowen (@intocryptoverse)

2:48 PM • Jul 11, 2023

TradFi Market Outlook 🧐

We now have:

1. CPI inflation at its lowest point since April 2021

2. First Core CPI inflation drop below 5.0% since December 2021

3. Fed “paused” interest rate hikes at last meeting

4. First jobs report miss in 15 months

Yet, more rate hikes are expected and bond markets are at their lows.

Something doesn’t add up here.

Inflation fell to its lowest annual rate in more than two years last month. The consumer price index increased 3% from a year ago, below estimates of 3.1%, which is the lowest level since March 2021. On a monthly basis, the index rose by 0.2%, better than forecasts of 0.3%. These numbers could give the Federal Reserve some breathing room as it looks to bring down inflation that was running around a 9% annual rate at this time in 2022, the highest since November 1981.

Following the CPI figure, the US dollar index traded lower just like the Treasury yields which allowed risk assets such as Bitcoin and the stock market to surge towards yearly highs.

The S&P500 reached yearly highs after breaking above the recent high of 4497 and is now trading around 4515. The softening inflation figure has clearly opened the door for risk assets to squeeze higher. Once again, as long as the index is trading above its 20-day moving average, it would be wise to remain bullish.

📈#BTC correlation with the Nasdaq fell to its lowest level in two years.👀

— Kaiko (@KaikoData)

7:53 AM • Jul 11, 2023

Crypto Market Outlook 📊

BTC’s correlation to other asset classes has significantly changed since the start of the year.

The 90-day correlation to the S&P500 declined from 0.40 to 0.10, its lowest level since June 2021, while the negative correlation to the US Dollar Index improved from 0.40 to 0.20 in the same time period.

Looking at price action, BTCUSDT is struggling to break and close above 30,850.

Once we break that barrier, prices will face their next challenge at 31,500.

Zooming out to the daily chart, as long as prices are trading above the 20-day moving average, just like the stock market, then you should remain bullish.

Tweet of the Day 🐦

Halving progress 80%. #Bitcoin

— Root 🥕 (@therationalroot)

7:24 AM • Jul 12, 2023