- Cipher Digest

- Posts

- 📰 Intense Market Fears, Crypto Showdowns, and Apple's Game-Changer: Get Ready for an Explosive Week in Finance! 💥📈🍎 | Cipher Digest

📰 Intense Market Fears, Crypto Showdowns, and Apple's Game-Changer: Get Ready for an Explosive Week in Finance! 💥📈🍎 | Cipher Digest

Another Monday has hit now and like you guys… we wish it was Friday.

Either way, there’s loaaadsss going on and its a HUGE week for the markets, here’s whats in today’s digest:

Last Week In Crypto 🪙💻

This Week's Watchlist 📆🔍

Today's News 🗞️📰

Mark Cuban VS SEC🤝🔍

Crypto Market Analysis 💸

TradFi Market Roundup 💼💰

Apple's Vision Pro & Metaverse Tokens 🍎🕶️

Tweets of the Day 🐦

Market Less Scared than last week…but still scared?

Last Week In Crypto

Despite a regulatory crackdown on crypto since 2017, China releases a whitepaper promoting web3 innovation in the territory (you LOVE to see it)

New Hong Kong licensing crypto regulations are now officially under effect

US lawmakers propose crypto regulatory clarity in new bill draft, stopping the SEC from denying digital asset companies registering as trading platforms

Binance to delist privacy tokens in France, Italy, Spain and Poland.

Hong Kong and UAE’s central banks look to collab on crypto & fintech development

ETH staking reaches new record highs

Nike NFTs to be integrated into EA Sports games.

US labour market remains resilient as job openings climb, layoffs drop.

What to Watch This Week!

TUESDAY: US CPI

WEDNESDAY: US PPI + US FOMC rate decision/economic projections

THURSDAY: ECB rate decision + US retail sales + US unemployment claims + BOJ rate decision

FRIDAY: US consumer sentiment

News of Today

Binance's BNB Token Futures: Hotter than Ever!

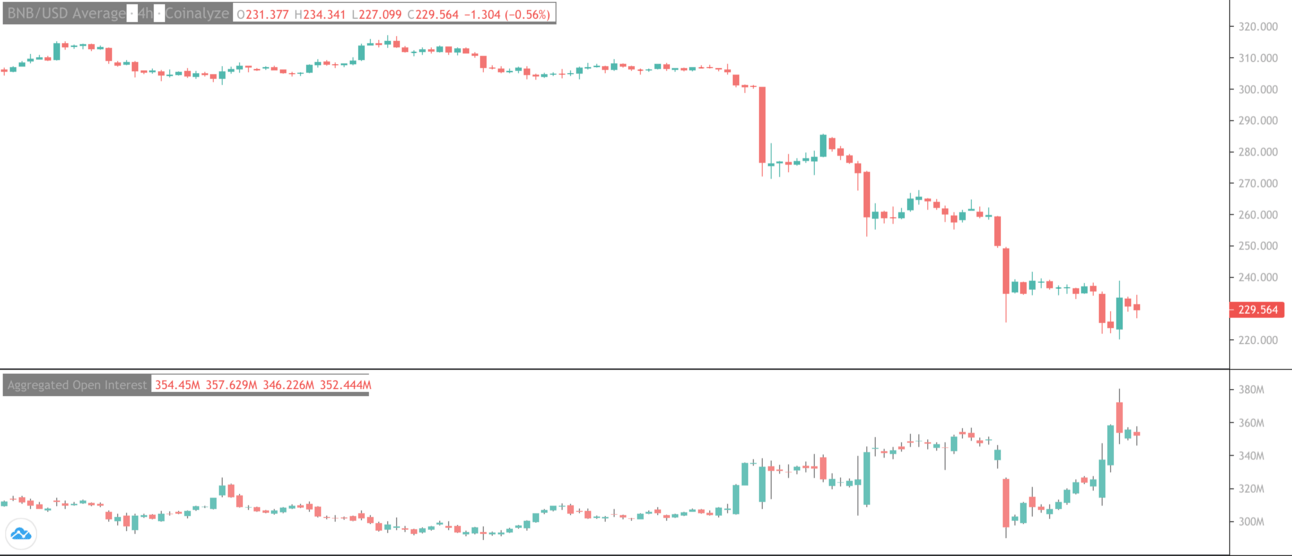

Open Interest Surges to 5-Month High Amid Bearish Market Trend

What a rush! The interest in BNB futures is reaching new heights, my friends. We're seeing a massive surge in open interest, which is the number of active and unsettled futures contracts tied to BNB.

Can you believe it?

The total open interest skyrocketed to 1.57 million BNB ($360 million) on Monday, making it the highest it's been since the start of the year.

Meanwhile, the market price of BNB took a dip, reaching a low of $221. It looks like more and more folks are jumping on the bearish bandwagon, expecting the price to keep on falling.

I’m thinking a pump might be in order to wipe out the short seller in the near term though.

Mark Cuban and the SEC: A Battle of Crypto Definitions

Securities in the Crypto Universe? "Near Impossible," Says Cuban

The one and only Mark Cuban, entrepreneur extraordinaire, is shedding light on the challenges of figuring out what qualifies as a security in the crypto space.

According to Cuban, the current regulatory framework is as clear as mud, making it a real headache to determine whether a token falls under securities regulations.

He's calling for some serious guidance from the SEC to bring some order to this chaotic crypto party. But hold on, Cuban also warns about going overboard with regulations, fearing they might stifle innovation. It's a tricky balancing act, my friends.

Personally, I think unless the US reacts quickly they risk all major Web3 and crypto companies leaving the country and will be cutting their nose to spite their face.

American Billionaire Mark Cuban argues it is “near impossible to know” what cryptocurrencies are securities, claiming the SEC hasn’t provided a public document outlining how firms can register. cointelegraph.com/news/impossibl…

— Cointelegraph (@Cointelegraph)

2:34 AM • Jun 12, 2023

Crypto Market Analysis

Digital Asset Investments Take a Hit: Outflows Reach Unprecedented Levels

The world of digital asset investments is experiencing some serious turbulence! Over the past eight weeks, we've witnessed a jaw-dropping total of $417 million flowing out of digital asset investment products. And wait for it...last week alone, $88 million said their goodbyes. Yikes!

So, what's causing this exodus?

It seems like the prevailing uncertainties in monetary policy are playing a significant role. Investors are getting jittery due to the indefinite continuation of interest rate hikes, and they're choosing to play it safe. Can't blame them for being cautious, can we?

But that's not all, The SEC has thrown a major curveball into the mix. They've initiated legal proceedings against two major players in the industry, Binance Holdings Ltd. and Coinbase Global Inc. On top of that, the SEC has slapped the "unregistered securities" label on several alternative crypto (altcoins), including big names like MATIC, SOL, and ADA.

Now, brace yourselves for the ripple effect. This regulatory scrutiny has created some serious liquidity challenges, especially for entities like Scimitar Capital. In response to this predicament, Scimitar Capital had to make a tough decision.

They pulled off a late-night liquidation of a whopping $2 billion worth of altcoins just this past Friday.

And guess what?

This move has only added fuel to the fire, sparking yet another sell-off in the crypto market.

Now into some chart breakdowns…

BTC has seen little movement so far this Monday, which is normal for a week when we have a lot of news.

Right now we are still holding the support of the bull flag which we highlighted last week. Personally, I am expecting a real scare to hit the markets this week prior to news events, followed by a recovery back into the channel.

On a break to the downside, I would look for some kind of support on the 200D moving average, around 23.6k.

TradFi Analysis

Consumer Price Index, Fed Policy, ECB & BOJ Rates - It's All Happening!

Hold onto your hats, folks, because we're in for a thrilling week of economic data and central bank decisions. Buckle up and let's dive in!

First up on Tuesday, we have the highly anticipated release of the Consumer Price Index (CPI). All eyes will be on this one, as it provides valuable insights into inflation trends and their impact on the economy.

But wait, there's more!

On Wednesday, the Federal Reserve will be making its policy decision. This is a biggie, as it has the potential to shake up the markets. Traders are crossing their fingers, hoping that the Fed will keep rates unchanged during their meeting.

As if that wasn't enough excitement, the European Central Bank (ECB) and the Bank of Japan (BOJ) will take the stage on Thursday to announce their respective rate decisions.

It's a global affair people!

Now, let's talk about the current state of the market. As we kick off the week, equity futures are looking mighty fine, with a positive start on Monday morning. Traders are feeling optimistic, and this positive sentiment is setting the tone.

Why the optimism, you ask? Well, it's largely because of the expectation that the Federal Reserve won't be implementing a rate hike during their policy meeting. Fingers crossed!

Speaking of the market, the S&P500 is on fire! It's been climbing higher and higher, reaching its highest point since April 2022. That's quite the achievement!

But here's a word of caution: the index has entered overbought territory today. It's straying quite far from its 20-day moving average. So, don't be surprised if we see a pullback towards that level, which sits around 4230.

Hold on tight, folks. It's going to be an exhilarating week filled with economic insights, central bank decisions, and market twists and turns. Get ready for the action!

How Has Apple’s Vision Pro Impacted Metaverse Tokens?

Apple has made a groundbreaking announcement! At the WWDC last week, Apple unveiled its highly anticipated Vision Pro headset. This news set the metaverse community abuzz, and crypto enthusiasts couldn't resist diving into tokens associated with Virtual Reality (VR), Augmented Reality (AR), and the Metaverse.

Apple's Impact: Metaverse Tokens Skyrocket Up to 168%

Starting from May 15, 2023, metaverse-related tokens experienced an incredible surge in value. Leading the charge was Ovr (OVR), the metaverse infrastructure token, which skyrocketed by a mind-boggling 168.6%.

However, the gains have since calmed down, with the price dropping to $0.44. This is normal after any news event, people take profits.

VFOX, the augmented reality token, posted the 2nd highest increase of 62.5%, climbing from $0.11 to $0.18. Interestingly, most of its price action occurred between May 30 and June 7, remaining relatively stable before that. On the virtual reality front, Somnium (CUBE) saw a respectable 39.2% increase during the same period.

Sandbox (SAND), the largest metaverse token by market cap, experienced a modest 17.7%.

Render's Rise: Overtaking Decentraland's Market Cap

Render (RNDR) enjoyed significant gains since May 15, surging by 49.2% from $1.83 to $2.72. This remarkable performance allowed it to surpass Decentraland's market cap. However, it experienced a price pullback following the Vision Pro launch.

While Render saw notable volatility throughout May and June, Decentraland (MANA) remained relatively stable. The MANA token ended the period almost unchanged at $0.463, representing a mere gain of 0.9%. However, on the day of the Vision Pro launch, it experienced a 10.4% price increase, which was quickly erased the following day.

Tweets of the Day 🐦

The effects of Operation Chokepoint 2.0:

- DEX volumes relative to CEX are at an all-time high

- Tether at ATH & USDC down 50%

- Offshore volumes near ATH at 86%In the end, capital & activity will just move off-shore & on-chain; ultimately giving the US govt less oversight.

— Will Clemente (@WClementeIII)

5:23 PM • Jun 11, 2023

Bybit Exchange announced that its founder team will use personal income to issue additional bonuses. Employees will receive an additional bonus equivalent to 1-5 months salary. It shows that the profits of offshore exchanges are still very high.

Bybit already issued a year-end… twitter.com/i/web/status/1…

— Wu Blockchain (@WuBlockchain)

9:14 AM • Jun 9, 2023