- Cipher Digest

- Posts

- Microstrategy Buys AGAIN, NFT Holders Get Ripped off, FTX is Back + more | Cipher Digest

Microstrategy Buys AGAIN, NFT Holders Get Ripped off, FTX is Back + more | Cipher Digest

The freshest, juiciest and most appetising market update report around.

Good Afternoon, Cipher is back and as always, we have the freshest, juiciest and most appetising market update report around.

In Todays Digest:

Market Overview 🌚

Latest in Web3 🚨

Charts of the Day 📊

What We’re Buying 💸

Crypto Market Analysis 📈

TradFi Market Outlook 🧐

Tweet of the Day 🐦

Latest in Web3 🚨

TrueUSD’s reserves were attested by former FTX US accounting team

Fidelity joins the battle for Bitcoin ETF supremacy

Nevada regulator filed to take over Prime Trust crisis company

European Union agreed on cryptocurrency bank capitals

Swiss National Bank will do a test run of CBDCs

The largest bank in Spain, Santander, says bitcoin can process more transactions, faster than Visa with "millions of transactions per second"

And last but not least …

BREAKING: FTX is moving ahead with efforts to revive its cryptocurrency exchange, per WSJ.

— unusual_whales (@unusual_whales)

9:32 AM • Jun 28, 2023

Chart of the Day 📊

Last week crypto investment products saw their largest weekly inflows of the year at $199 million.

#bitcoin hash rate being so high miners have to sell their #btc to meet operational costs

— few (@fewseethis)

6:10 PM • Jun 27, 2023

Some NFT News! 🖼️

Azuki NFT Prices Slide 44% After Creator Releases 'Basically Identical' Elementals

Chiru Labs, the “creative geniuses” behind the Azuki NFT collection, recently unveiled their latest project called Elementals.

But hold onto your hats, because things took a dramatic turn!

In a surprising twist, the floor prices of the Azuki NFT collection plummeted by a whopping 44% within just 24 hours.

The reason? Well, it seems like the holders and market watchers weren't exactly thrilled with the newly introduced Elementals collection.

Let's rewind a bit. Chiru Labs dropped the Elementals collection on Tuesday, and within 15 minutes, they raked in a jaw-dropping $38 million. But here's the kicker: some members of the NFT community couldn't help but notice a striking resemblance between Elementals and the beloved Azuki collection, which was released back in February 2022.

Did Azuki just raise $40 million to release the Walmart version of Azuki?

— becc (@cryptobecc)

7:04 PM • Jun 27, 2023

"Azuki really sold a 20K collection at 2 ETH exclusively to their own holders, extracting $40MM, only for the art to be revealed as basically identical to the main collection. Bluechip bagholders in disbelief."

To make matters worse, a side-by-side comparison of the two collections revealed undeniable similarities. From facial structures to angles and the general vibe, it was hard to ignore the resemblance. Some even dubbed Elementals as a cheaper knock-off of the original Azuki collection. Yikes!

ONE IS AN AZUKI AND ONE IS AN ELEMENTAL…. OMG … WHAT THE FCKKKKKKKKKK … I am down so much fucking money man …. FUCKKKKNN

— Wizard Of SoHo (🍷,🍷) (@wizardofsoho)

7:17 PM • Jun 27, 2023

Crypto Market Analysis 📈

Bitcoin

The man just can’t get enough, Michael Saylor, the CEO of Microstrategy has announced that they have acquired an additional 12,333 BTC, for $347 million.

They now hold *checks notes* … ahem… 152,333 BTC.

Thats a lot.

Overall they have spent $4.52 billion at an average buy price of $29,668. So they ARE currently in profit, unlike the rest of us LOL.

BTC has shown little overall movement and has been ranging between $29.9k and $30k. Markets are consolidating and uncertain.

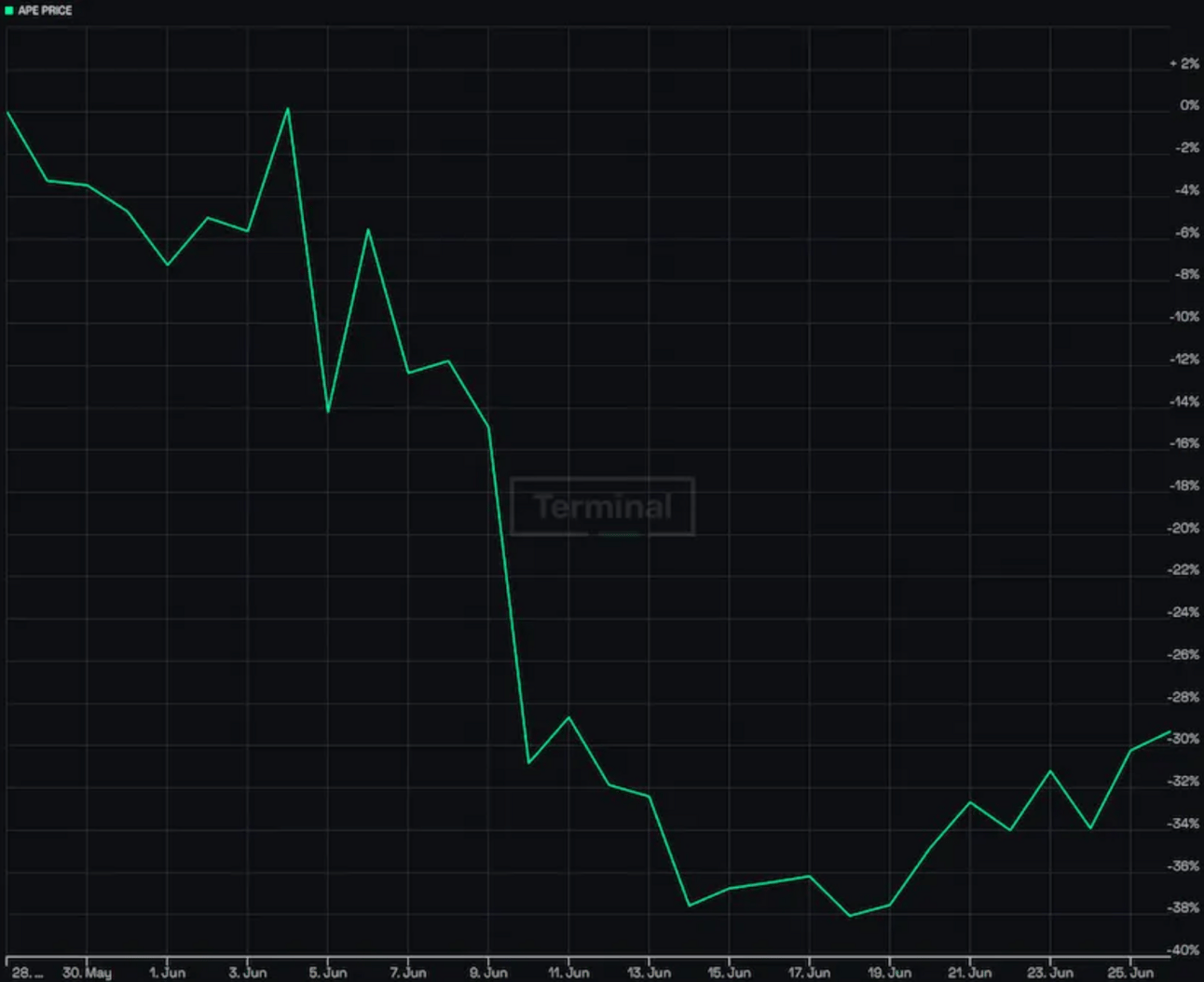

TLDR Bored Ape Yacht Club (BAYC) and other Yuga ecosystem assets have had a rough month, with APE hitting an all-time low on June 19. An ongoing Special Election seeks to invigorate the ecosystem's governing body, the ApeCoin DAO. The struggle to define clear roles and responsibilities within the ApeCoin DAO, along with the high salaries of its council members, indicates inherent governance challenges.

SO WHAT The ongoing downtrend raises concerns about the long-term sustainability and effectiveness of DAOs in managing NFT collections and their related token ecosystems. As one of the most impactful NFT collections, the BAYC and ApeCoin's future trajectory will likely influence the broader NFT and DAO space, setting either an example to follow or a cautionary tale.

TradFi Market Outlook 🧐

Believe it or not… we are approaching the close of the strongest first half for the Nasdaq in FOUR decades!

A lot of this bullish and positive sentiment is coming from the optimism surrounding the field of Artificial Intelligence, which has been propping up high-value tech stocks.

The Nasdaq has risen 29%, while the SP500 has risen 14%. That’s REALLY good in the stock market btw.

Today, the Chair of the US Fed, Jerome Powell, is giving a speech in Europe. Quite often the words of this man have a big impact on the markets, so it’s important to always keep an eye out on what he says.

The overall vibe we are getting from his speech is that…. things are not looking good. There was very little positivity around what he was saying.

The markets initially wicked to the downside before ultimately moving back up to weekly highs. The markets simply don’t believe him, they believe he’s just trying to push markets down.

Powell: There is a significant probability we get a recession.

— unusual_whales (@unusual_whales)

2:05 PM • Jun 28, 2023

A U.S. recession is coming this year, HSBC has said.

— unusual_whales (@unusual_whales)

1:01 PM • Jun 28, 2023

Tweets of the Day 🐦

Azuki founders after launching the same exact NFTs at a 2 ETH mint price

— LilMoonLambo (@LilMoonLambo)

10:19 PM • Jun 27, 2023