- Cipher Digest

- Posts

- The Shocking Secrets of Litecoin's Meteoric Surge, Hidden Fortunes in the Bear Market, Gate.io's Cryptic Conundrum | Fridays Cipher Digest

The Shocking Secrets of Litecoin's Meteoric Surge, Hidden Fortunes in the Bear Market, Gate.io's Cryptic Conundrum | Fridays Cipher Digest

Hey, it’s FRIDDDAYYYY and this is Cipher Digest, the only newsletter that DOESN’T complain about the hot weather.

Let’s get started so we can finish and get ready for the weekend:

What to Watch this Weekend 🔍

Gainers and Losers 💹

Fact of the Week 📚

Market Updates 📈

Tweet of the Day 🐦

GIF

Here’s 3 things to Watch in June ⛱️

Let’s start with the bad news…

1/ June has been a red month for BTC & ETH in recent years.

Last June was Bitcoin’s worst month in a decade. Inflation, high interest rates, & low market liquidity will do that to ya.

So will this June suck too? We hate to break it to you, but there’s 1 key factor that might make that the case…

2/ Interest rate hikes

AKA the only term scarier than “we need to talk.”

The Fed might vote to raise them in mid-June. Threat of higher federal interest rates = less likely people are to buy risky assets (like crypto/BTC.)

Womp womp.

But on to the good news!

3/ Hong Kong started letting retail investors buy/sell crypto today

Time to celebrate 🍾

Why? Because ~7.4M more people being able to trade crypto is like your buddy showing up with a 24 pack of beer for mass adoption - it swings that door wide open.

It’s also a win since China has been so iffy about how to (or if it would) welcome crypto. Hong Kong’s move could expand throughout China, too.

This Weeks Winners

Which crypto coins and tokens with volume (24h) > US$50,000 have gained or lost the most in the last 24 hours? (Top 100)

This Weeks Losers

Fridays Facts

Not to be a know it all… but did you know?

The most expensive pizza in history was bought with Bitcoin.

Back in 2010, a programmer named Laszlo Hanyecz made history by purchasing two pizzas for a staggering 10,000 BTC. Today, those same bitcoins would be worth millions of dollars, making it a bittersweet treat for Laszlo.

The world's first blockchain-powered marriage took place in 2014.

A couple in Texas decided to tie the knot using a blockchain contract, making their marriage certificate immutable and transparent. Talk about taking "forever and always" to a whole new level!

Ethereum's co-founder, Vitalik Buterin, was inspired by a popular online game to create Ethereum.

He drew inspiration from the game "World of Warcraft" and envisioned a decentralized platform where users could create, trade, and interact with virtual assets. So, next time you dive into the world of Ethereum, remember that it all started with a hint of gaming magic.

BTC & ETH Update

Delving into the realm of volatility, let's take a closer look at the 30-day volatility levels for two crypto heavyweights: BTC and ETH. Brace yourself for historically low levels, as BTC clocks in at 0.016, while ETH follows suit at 0.019. These numbers highlight the current environment's striking calmness.

Let's explore how it differs across various asset sectors to gain a more comprehensive understanding of market volatility. In 2023, the DeFi sector takes the crown for its exhilarating swings. With assets dancing around a staggering 40% range, it's safe to say that this sector knows how to keep us on our toes.

On the flip side, we encounter the bastions of stability, the Safe Havens: Stablecoins and Tokenized Assets. However, even these pillars of consistency experienced a momentary disruption when USDC and DAI momentarily lost their peg during the Silicon Valley Bank collapse. An unexpected twist in an otherwise calm narrative.

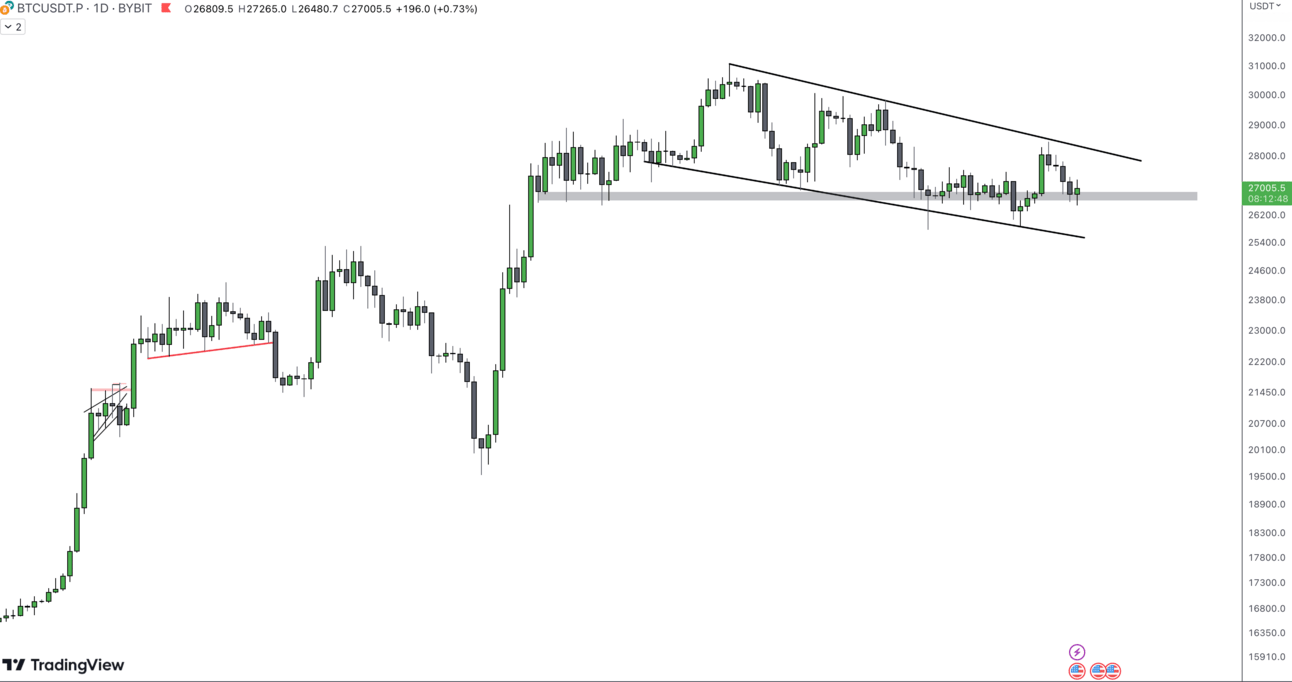

Shifting our focus to the ever-volatile BTCUSDT, we witness an intriguing price action. Our expedition takes us to the support target of 26,600, where we experienced a resilient rebound driven by substantial trading volumes. As we chart our course ahead, we anticipate a period of sideways movement, leaning towards a slight bullish bias as we make our way back to 27,600.

For the intrepid souls seeking entry points, a potential correction towards 25,900 beckons with alluring possibilities for long positions. However, should the heavens align and a breakout occur at 28,500, bullish implications take center stage, propelling prices towards the lofty heights of 29,550.

Prepare your trading sails, adventurers, for the crypto seas hold both hidden treasures and tumultuous tides. Navigate wisely, for fortune favors the bold in this ever-evolving landscape.

News Headlines

1- Unveiling the Enigma Behind Litecoin's Soaring Activity

Litecoin sets the stage for an impressive start to June, as its price skyrockets, claiming a remarkable 7.5% surge over the past 30 days. Surpassing both Bitcoin and Ethereum, this achievement marks the third-best performance among crypto assets. But what's the secret? All eyes are on the upcoming halving event in August, anticipated to propel Litecoin to new heights.

2- Embracing the Bear: A Golden Opportunity for the Believers

As centralized exchanges witness dwindling trade volumes reminiscent of the bear market cycle, a unique opportunity arises for the resilient few. With daily volumes plunging to levels last seen in late 2020, market apathy seems to prevail. However, contrarian investors with unwavering conviction and faith in the market stand poised to seize the hidden gems within this period of indifference.

3- Gate.io's Unraveled Mystery: Unveiling the Truth Behind the Speculation

A storm of speculation swirls around Gate.io following allegations of insolvency. Coinsumption, a prominent Twitter account, sounded the alarm, urging users to withdraw their funds. The plot thickens as the Multichain project encounters significant hurdles, including mysterious team disappearances and server access issues. With MULTI token deposit halt on Binance triggering a snowball effect, uncovering the truth becomes paramount.

4- Shaping the Future: How U.S. Commodities Agency Considers Crypto Risk Rules

The U.S. Commodity Futures Trading Commission (CFTC) embarks on a transformative journey by contemplating updates to its risk management rules. This crucial step aims to establish a comprehensive framework that addresses the unique characteristics of cryptocurrencies. By integrating digital assets into traditional financial frameworks, the CFTC endeavours to ensure robust risk monitoring and evaluation, potentially reshaping the regulatory landscape as we know it.

Tweet of the Day

⚠️BREAKING:

*U.S. ECONOMY ADDS 339,000 JOBS IN MAY

*U.S. UNEMPLOYMENT RATE RISES TO 3.7%

🇺🇸 🇺🇸

— Investing.com (@Investingcom)

12:37 PM • Jun 2, 2023