- Cipher Digest

- Posts

- US Launching a CEX, BTC Short Squeeze?, Market Outlook + more | Cipher Digest

US Launching a CEX, BTC Short Squeeze?, Market Outlook + more | Cipher Digest

There has been ALOT going on today in the world of finance, catch up in just 5 mins.

Happy Midweek! Cipher is here again to give you everything you need like an orange gummy vitamin.

Before we hope into today’s Digest, take a look at what Fed Chair Powell just said… (I cant really believe it)

JUST IN: 🇺🇸 FED Chair Jerome Powell says "we see stablecoins as a form of money."

— Watcher.Guru (@WatcherGuru)

2:45 PM • Jun 21, 2023

In Todays Digest:

Latest in Web3 🚨

Market Overview 🌚

US Launching an Exchange?! 🦅🇺🇸

Chart of the Day 📊

Going from 🐻 to 🐂

Crypto Market Analysis 📈

TradFi Market Outlook 🧐

Tweet of the Day 🐦

Latest in Web3 🚨

Bitcoin price explodes to $29K, leaves $150M liquidated

$1.5 Trillion asset manager Invesco reactivates Bitcoin spot ETF filing

EDX crypto exchange launches backed by Fidelity, Schwab, Citadel

Deutsche Bank applies to German regulator for crypto custody license

Layer 2 Polygon wants to upgrade Polygon PoS chain compatible with zkEVM

Whats with the Market? 🧐

🚨Breaking : US is launching it's Own Crypto Exchange 🚨

Group of America's largest investment firms—including Citadel, Charles Schwab and Fidelity Digital Assets—are launching a BTC exchange this week.

What does this mean?

The US certainly has made quite an entry in the headlines the past few weeks. The SEC opened multiple regulatory crackdowns on the most famous crypto exchanges. Many people said crypto will be dead in the US.

But will it really or has there been an ulterior motive behind it?

EDX Markets has just been announced today… Impeccable timing no? EDX is a newcomer to the crypto exchange landscape. It has made a notable entry with backing from prominent financial institutions such as Citadel Securities, Fidelity Investments and Charles Schwab.

The company unveiled the launch of its digital asset market yesterday on June 20. The exchange hopes to attract “industry leaders” by incorporating best practices from tradfi and offering unique advantages.

Have they really been against crypto all this time or did they just want a large piece of the pie themselves? Trying to ban the exchanges out of their reach but launch an exchange so they can hog up all the fees and/or profits for themselves?

There certainly seem to be a lot of coincidences these days. One thing is for certain though: The institutions might not be that far away as many of us thought.

𝐓𝐡𝐞𝐲 𝐚𝐫𝐞 𝐚𝐥𝐫𝐞𝐚𝐝𝐲 𝐡𝐞𝐫𝐞.

Breaking 🚨 : US 🇺🇲 is launching it's Own Crypto Exchange .

Group of America's largest investment firms—including Citadel, Charles Schwab and Fidelity Digital Assets—are launching a #bitcoin exchange this week.

— BITCOINLFG® (@bitcoinlfgo)

3:22 PM • Jun 20, 2023

Chart of the Day 📊

Bitcoin Open Interest is once again getting to levels where historically, squeezes have occurred. Good to note that we're already higher than usual and even with the short squeezes that happened, the open interest keeps coming back quickly.

This is on Bybit.

Interesting to note that the market has not actually short squeezed yet, instead someone is just buying ALOT of BTC and pushing the market up.

This is not a short squeeze, but someone(s) is just buying $BTC a lot.

I repeat.

This is not a short squeeze, but someone(s) is just buying $BTC a lot.

cryptoquant.com/analytics/dash…

— Ki Young Ju (@ki_young_ju)

1:50 AM • Jun 21, 2023

Going from 🐻 to 🐂

Just last week, the entire market was SCARED that the SEC was going to destroy crypto by bringing down the exchanges. Now… just a little while later… the entire market is bullish again.

This shows you the huge change the takes place in the markets. This happens all the time.

The key is to keep calm, look at the market in a neutral way no matter what the media is throwing at you.

There would have been people last week that did buy, long or maintain a bullish outlook. They are the ones that have made money.

Look at the market for what it is, not for what you’re shown.

Crypto Market Analysis 📈

Total Crypto Market Cap has successfully retested the very bottom of the green support area (old resistance), and has reclaimed new support.

A strong technical sign of developing macro bullish momentum market-wide over time!

BTC has been on a TEAR.

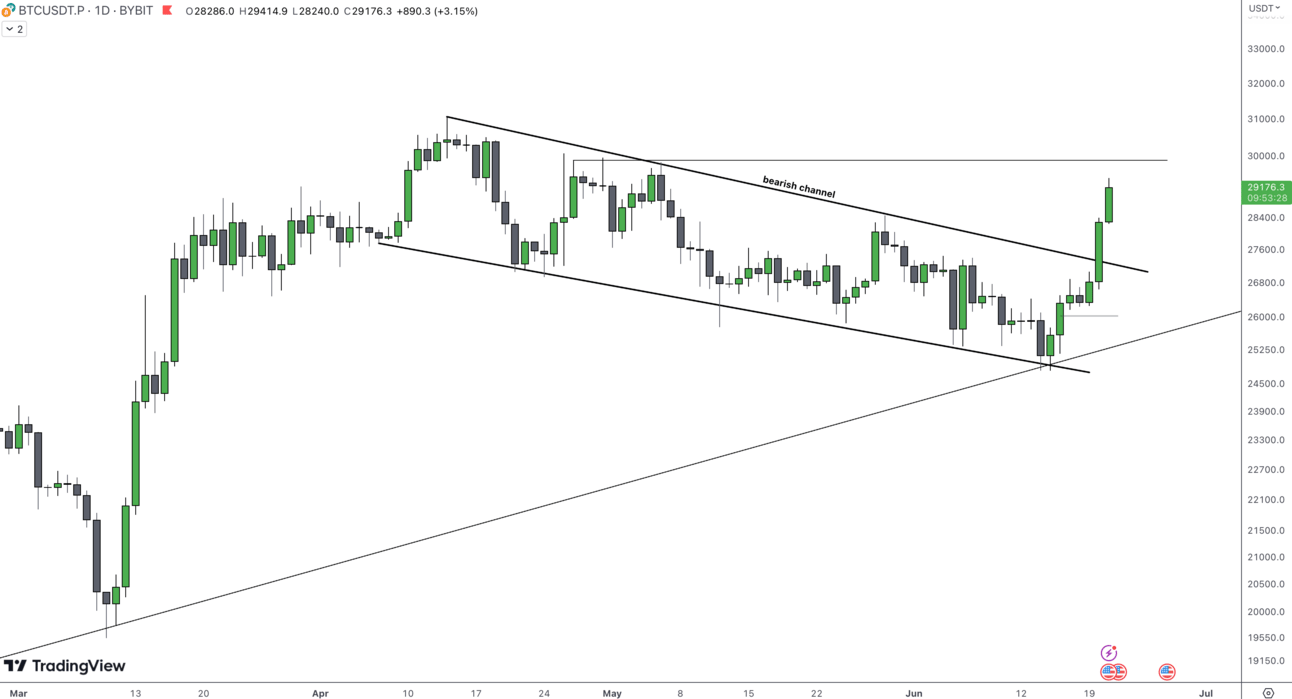

As shown on the chart below, the bearish downtrend channel has now been convincingly broken. This is a major sign of a uptrend. For any of the traders out there, I wont be looking too short until we see a major High Timeframe reversal signals.

An overnight rally in BTC) led the major alts, most notably Cardano (ADA) and Ethereum (ETH) to surge as much as 7% and post one of the largest single-day gains this month.

Overall crypto market capitalisation rose 5% over the past 24 hours, adding nearly $50 billion in value. The surge caused $125 million in short liquidations across crypto-tracked futures.

TradFi Outlook 👀

Fed Chair Powell, today, reaffirms that more rate hikes are likely as inflation remains “well above” where it should be. The odds of a 25 basis point rate hike in July just hit 80%. There’s now a 15% chance of 2 more rate hikes by September.

The Fed is not backing down. What does this mean though?

It means that the Fed is still trying to keep the expectations of the market low and realistic. So when it does come to the time and they raise rates, no one is surprised.

As shown on the chart below, the NASDAQ has pulled back and rejected on the grey resistance that we highlighted in last weeks updates.