- Cipher Digest

- Posts

- XRP UP 30%, US Gov Sells BTC, Dollar Collapses + more | Cipher Digest

XRP UP 30%, US Gov Sells BTC, Dollar Collapses + more | Cipher Digest

THIS IS NOT A DRILL! XRP IS NOT A SECURITY!!

THIS IS NOT A DRILL! XRP IS NOT A SECURITY!! So much more in today’s digest let’s ROLL ON!

In Todays Digest:

Market Overview 👁️

Latest in Web3 🚨

Throwback Thursday - The NFT which almost never happened 🖼️

Chart(s) of the Day 📊

Why the US dollar Matters 🇺🇸

Crypto Market Analysis 📈

TradFi Market Outlook 🧐

CONGRATS XRP 💸

Latest in Web3 🚨

Europe’s first Bitcoin ETF finally launches

US Government transfers $300 million worth of seized Silk Road bitcoins

Digitex founder ordered to pay $16M to resolve CFTC action

EBA publishes stablecoin issuance guidelines under MiCA regulation

Vanguard increases investments in Bitcoin Mining

Throwback Thursdays

The NFT which almost never happened 🖼️

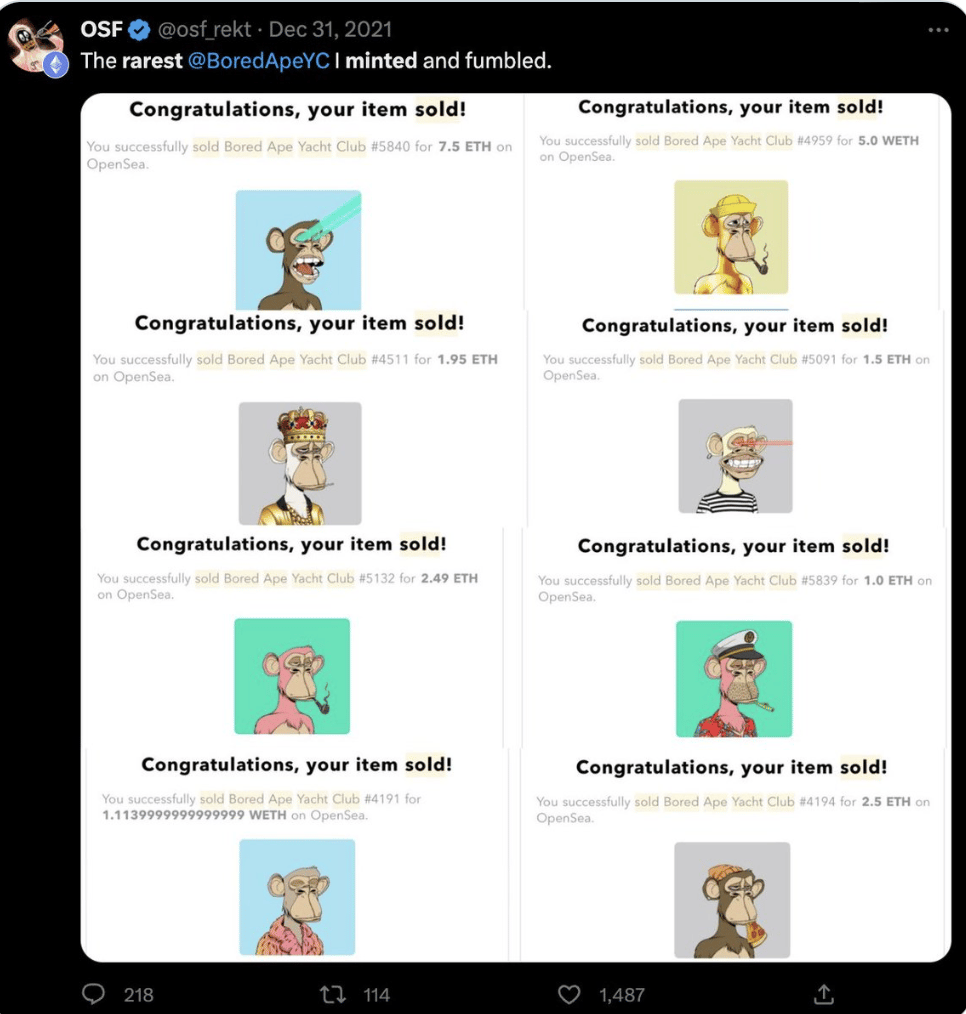

Throwback to May 2021. @osf_rekt quit his job and minted 150 BAYC. He tried convincing his friend @rektmando to join in on the fun...

But, Mando was having none of it.

Mando actually convinced OSF to sell most of his 150 BAYC for only 0.4 ETH! Generational wealth was slipping through OSF's fingers and he didn't even know it...

OSF held some rare BAYC including a Gold Fur. But, he paper-handed those just weeks later too...

Mando then had a change of heart. He aped into 72 BAYC at around 4 ETH each.

A few weeks later, OSF & Mando decided to combine their portfolios. OSF added some iconic art pieces like @XCOPYART and Pegz by @matt_furie while Mando primarily brought the Apes.

OSF then dropped the hammer down on NFT Twitter outlining his BAYC thesis...

He boldly stated BAYC would overtake punks when BAYC was 33 ETH and Punks were 75. His reasoning was:

Valuable IP

High # of buyers

Strong community

Potential token airdrop

Global brand & celebrity endorsement

OSF was right!

Many people bought into the Ape thesis and the price kept grinding higher. Sidelined folks hated the ascent and their cope seemed to drive the price even higher.

The rise was face-melting... and they held all the way to the top...

BAYC's floor peaked at 142 ETH. For holding their BAYCs... OSF & Mando also got to claim MAYC, Otherdeeds, Sewer passes and $APE for FREE. Totalling ~$10M! They sold some of these NFTs to realize profits right before...

BAYC crashed as the stock market collapsed and took crypto with it. It bottomed down 87% in USD from the highs. OSF & Mando couldn't even sell if they wanted to because NFT liquidity was poor and they held so much supply. But, a new revelation started unfolding in NFTs when...

~$300M of $BLUR was airdropped NFT holders... Blur teased another potential 9-figure airdrop for bidding and listing NFTs on their marketplace too. The battle to earn a share of the next huge airdrop intensified as traders aggressively bid on collections to earn $BLUR.

They sold all 72 BAYC into bids on Feb 22nd, 2023. $9.15M realized instantly with no price impact. Boosting their total profits to ~$18M.

Chart(s) of the Day 📊

BTC Will RUN 🏃♂️

Whichever way #Bitcoin turns above or below 30k, a serious amount of 100x leverage awaits

— James V. Straten (@jimmyvs24)

3:19 PM • Jul 12, 2023

The above chart shows the extreme amount of leveraged trades currently active in the market. This is very common when we see consolidation and sideways price action like we have been seeing over the past 3 weeks.

Why is this a big deal?

Well when prices start to move… they dont stop.

For example, when the price finally breaks above $32,000, all of those shorts start to get liquidated, pushing the price higher. This liquidates more longs, pushing prices higher, which liquidates more longs, and so on.

This is known as a SHORT SQUEEZE.

The same in reverse is a long squeeze.

We can’t promise you where the price will go, BUT, I can tell you it will be a fast and aggressive move.

Why the US dollar Matters 🇺🇸

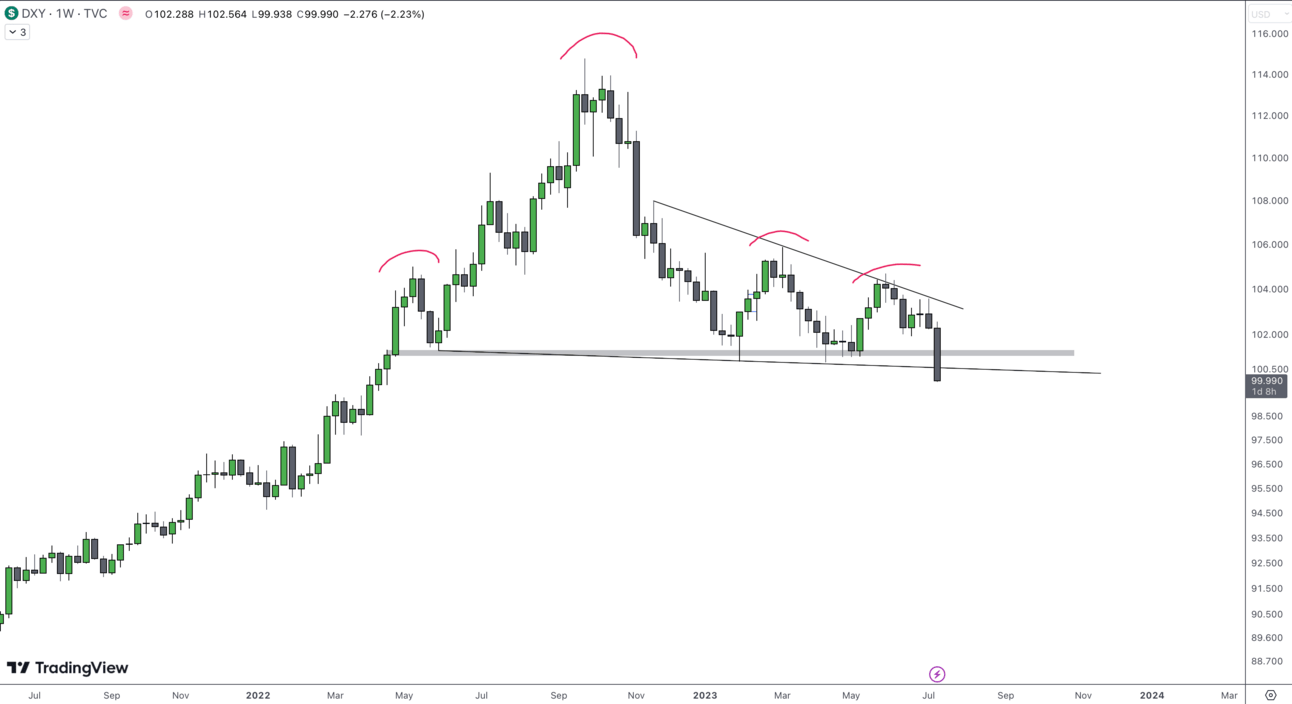

One intriguing relationship is the correlation between the U.S. Dollar Index (DXY) and Bitcoin (BTC).

The DXY measures the value of the U.S. dollar against a basket of other major currencies, while BTC is the most prominent and widely recognized cryptocurrency. Although they operate in different realms, an examination of their correlation provides valuable insights into the dynamics between traditional fiat currencies and the emerging digital economy.

Understanding the DXY:

The DXY serves as a benchmark for measuring the strength or weakness of the U.S. dollar compared to other major currencies like the euro, Japanese yen, British pound, and others. It is composed of a weighted average of these currencies, reflecting their relative importance in international trade.

Changes in the DXY value are driven by various factors, including economic indicators, interest rates, geopolitical events, and central bank policies.

Correlation between the DXY and BTC:

When examining the correlation between the DXY and BTC, it's important to note that both assets are influenced by a wide range of factors.

In general, they exhibit an inverse relationship, meaning that when the DXY strengthens, Bitcoin tends to face downward pressure, and vice versa.

This correlation is rooted in several key factors:

Safe-Haven Assets: The U.S. dollar has long been considered a safe-haven currency during times of economic uncertainty. When investors seek refuge from market volatility or geopolitical tensions, they often flock to the dollar, causing it to appreciate. In such scenarios, Bitcoin, often referred to as "digital gold," can experience a decline in demand as investors move away from riskier assets.

Monetary Policy: Central bank policies, particularly those of the U.S. Federal Reserve, can impact both the DXY and Bitcoin. When the Federal Reserve implements expansionary monetary policies such as lowering interest rates or engaging in quantitative easing, it can lead to a weaker dollar and potentially drive investors towards alternative assets like Bitcoin.

Inflation Concerns: Inflationary pressures have a significant influence on both the DXY and Bitcoin. When inflation expectations rise, the value of traditional fiat currencies may decline, prompting investors to seek inflation-resistant assets like Bitcoin. As a decentralized cryptocurrency with a limited supply, Bitcoin is often viewed as a hedge against inflation, thus exhibiting an inverse correlation to the DXY during inflationary periods.

So what does the DXY tell us now?

The dollar is finally breaking down from a complex head and shoulders (two right shoulders) and threatening to break 100.

Risk assets look poised to go absolutely CRAZY.

Now with this remember that the correlation which BTC has had to the traditional finance market has not fallen to all-time lows, this is not a coincidence.

The market is in uncharted waters, if you’re a trader, trade with caution.

Crypto Market Analysis 📈

The SEC, DOJ, CFTC, and FTC sues Celsius Network and Alex Mashinsky in a New York federal court. Celsius, the bankrupt crypto lender, collapsed last year amid early crypto distress.

This morning, its CEO Alex Mashinsky was arrested and charged with fraud as well as a scheme to manipulate the crypto market.

The regulator alleges that:

“Defendants falsely promised investors a safe investment with high returns through its “Earn Interest Program,” they misled investors about the financial success of Celsius’s business, and they fraudulently manipulated the price of Celsius’s own crypto asset security—the so-called “CEL” token.”

BTCUSDT is stuck in a tight range between 29,900 and 31,250.

As much as the stock market gained a lot of inflows following the soft inflation print, the crypto market overall isn’t feeling the same amount of love.

We’ve noticed in the past that sometimes there’s a lag between the overall liquidity and the crypto market.

It doesn’t help when we keep witnessing negative headlines regularly coming out. As long as the US Dollar Index is coming down, then risk assets should continue to flourish.

Not sure what the exact catalyst will be, but eventually, Bitcoin will break above these yearly highs and test the next major resistance and break $35k.

In the short term though, we look for some blood in the markets.

TradFi Market Outlook 🧐

The S&P500 is trading at the highest level in more than a year.

The index keeps reaching higher levels as the Dollar Index is falling to the lowest figure since April 2022.

As we broke above the 4500 level, our next target is in the 4600 range.

CONGRATS XRP 💸

BREAKING: 🇺🇸 US judge rules Ripple $XRP is not a security.

— Watcher.Guru (@WatcherGuru)

3:35 PM • Jul 13, 2023

Ripple case, here is the good and the bad.

But it is mostly VERY good for all alts, and a surprisingly big win for XRP.

First Judge did decide institutional sales/fundraising was securities.

But, that the programmatic sale on exchanges didn't meet third prong of Howey.

So sales to users via exchanges was fine, as long as it was through orderbook and not ICO/IEO/Launchpad-like things.

Bounties, investments in others using XRP, grants using XRP, and transfers to execs in XRP not considered securities.

Overall a huge win. XRP is one of the more centralized foundations, with a key figure head, who had standard sales via exchanges, and formal distribution programs. If those aren't securities, nearly nothing sold via exchanges is.

Moral:

Don't do institutional private rounds/OTC

Sell via exchanges

Distribute via protocol natively

Fuck you Gensler.