- Cipher Digest

- Posts

- opBNB Airdrop Tutorial, SEC is WILDIN, $6.2 BILLION Missing & more | Cipher Digest

opBNB Airdrop Tutorial, SEC is WILDIN, $6.2 BILLION Missing & more | Cipher Digest

opBNB Airdrop Tutorial, SEC is WILDIN, $6.2 BILLION Missing & more | Cipher Digest

Have you ever been doing homework and in a mad rush, made a mistake? Or been at work and pressed for a deadline, and made a typo?

That’s what happened at the US Pentagon recently, but instead of accidentally sending a meme to their boss…. they accidentally spent $6.2 Billion…..

No no no, you read that right… $6.2 BILLION, with a B.

Read a full article on that here.

Made a $6.2 Billion “Accounting Error”

In Todays Digest:

Latest in Web3 🚨

How to Be Part of the Largest Airdrop in History 🌚

Crypto Market Analysis 📈

TradFi Market Outlook 🧐

Crypto Word of the Day 🤌🏽

The Latest Breaking News 🚨

The new Layer 2 chain called opBNB has been launched. Brace yourself for the largest airdrop in history!

Fed chair says stablecoins are a form of money

Valkyrie updates its filling for spot Bitcoin ETF to list in Nasdaq

Circle restarts U.S. treasury purchases in BlackRock-managed USDC fund

Bankrupt hedge fund 3AC's return as a VC stirring up crypto community

HSBC, Mastercard file more crypto-related trademark applications

How to Be Part of the Largest Airdrop in History 🌚

Yesterday, Binance dropped a bombshell: opBNB - an EVM blockchain built on Optimism, which aims to solve the scalability issue of BSC.

opBNB was recently launched in Testnet, and the Mainnet is scheduled to launch in Q3 of 2023.

Binance is sitting on a goldmine, and early adopters could score big with their potential airdrop.

Airdrop Strategy 🪂

Step 1: Request testnet tokens.

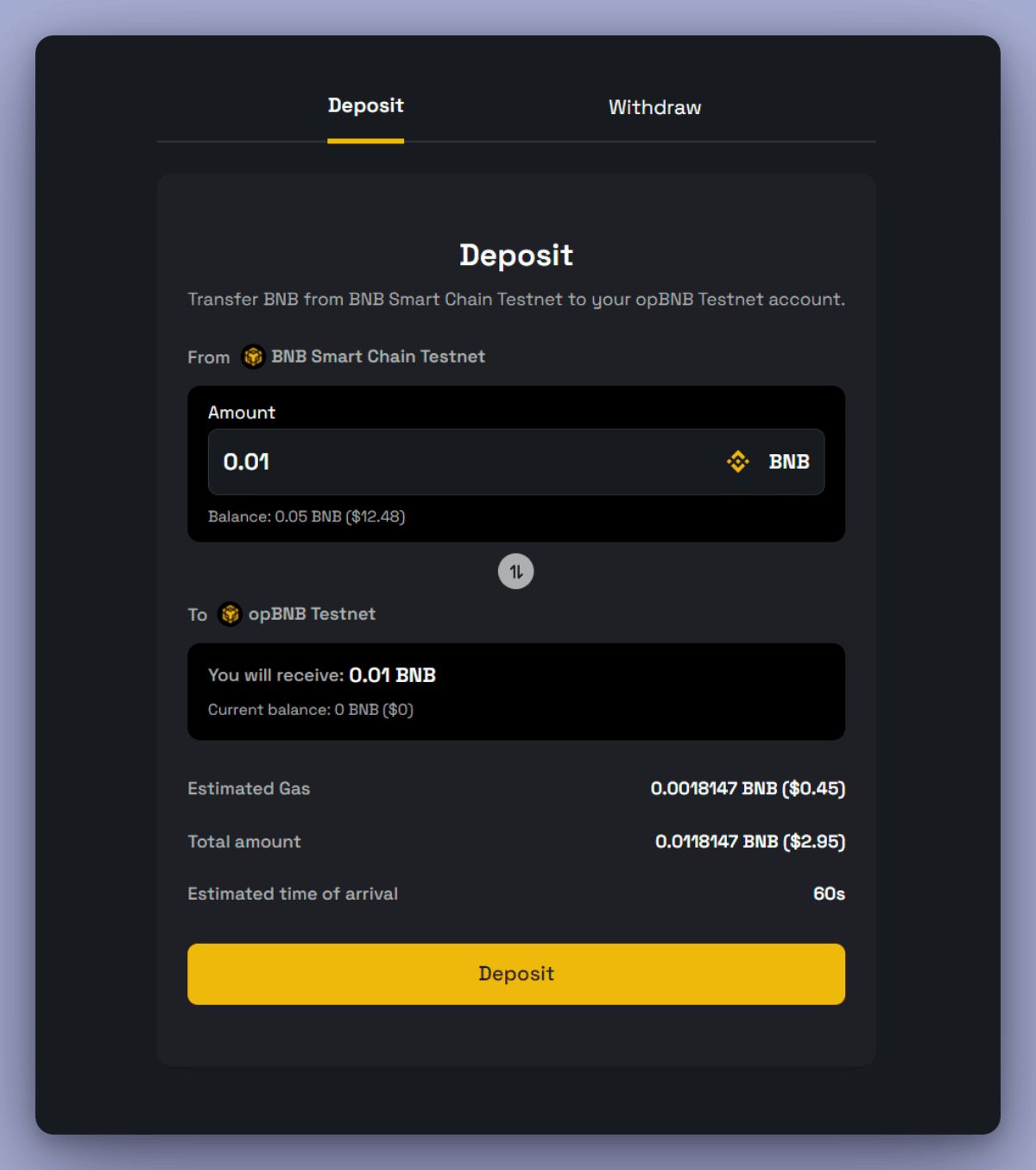

Step 2: Bridge your tBNB to opBNB.

▻ Connect your wallet

▻ Click on 'Deposit' and confirm transaction

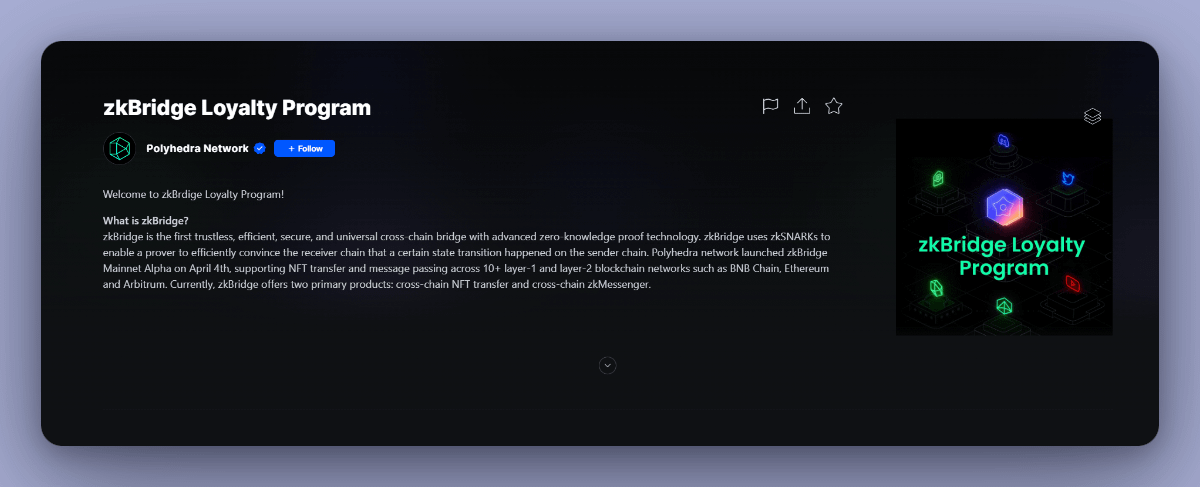

Step 3: Go to https://zkbridge.com and connect your wallet.

▻ Switch to BNB Chain Testnet

▻ Click on NFT Faucet

▻ Select ZkBridge on opBNB

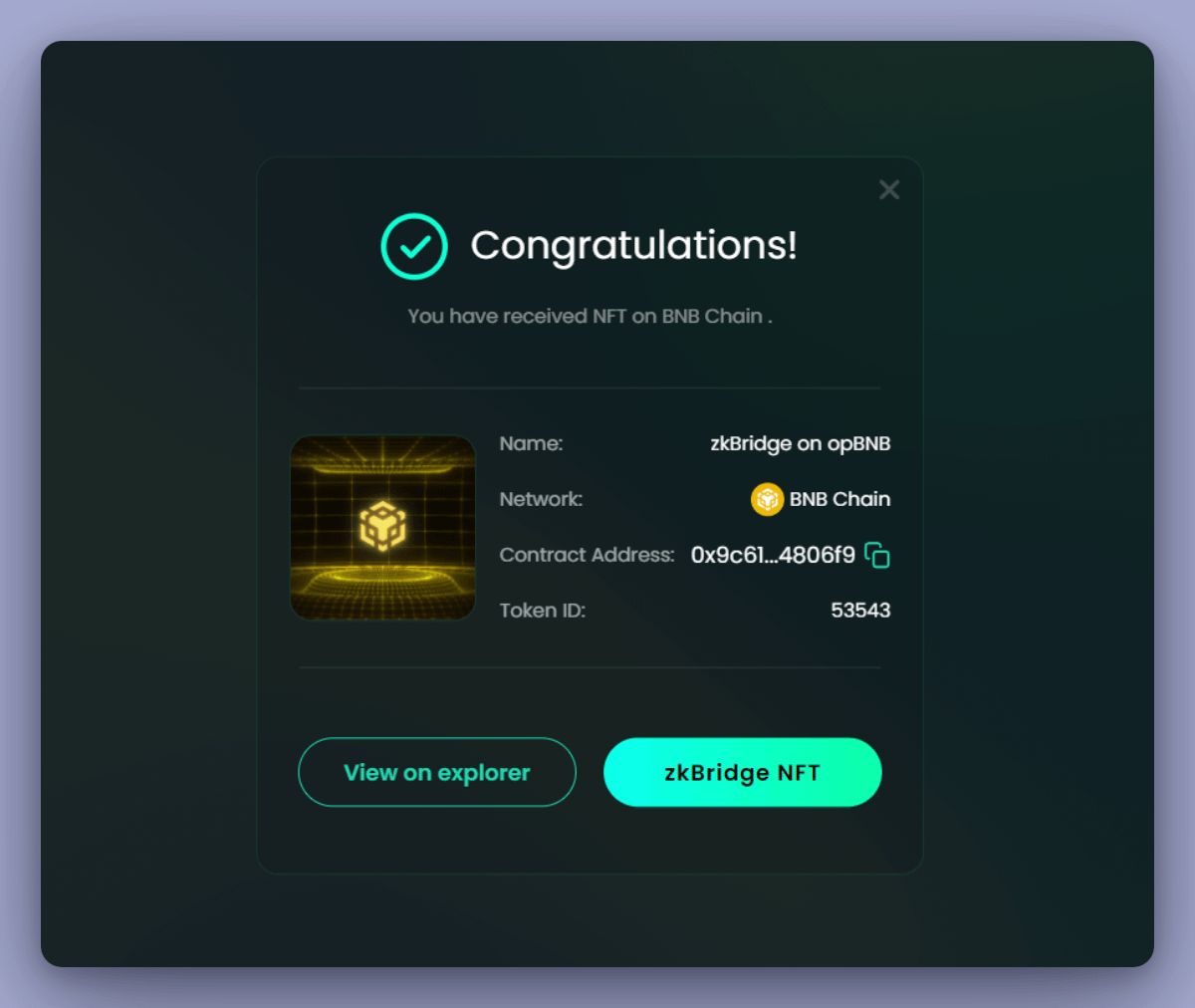

▻ Switch on BNB chain and claim your NFT

|  / |

Step 4: Bridge your NFT to opBNB network.

▻ Hit on 'ZkBridge NFT'

▻ Import your NFT

▻ Select opBNB network

▻ Approve and Confirm transfer

▻ Claim your NFT

Step 5: Claim your points on Galxe.

▻ Claim 'opBNB NFT Mint' & 'opBNB NFT Cross Chain'

Just a heads up, eligibility might take a few minutes to display.

Crypto Market Analysis 📈

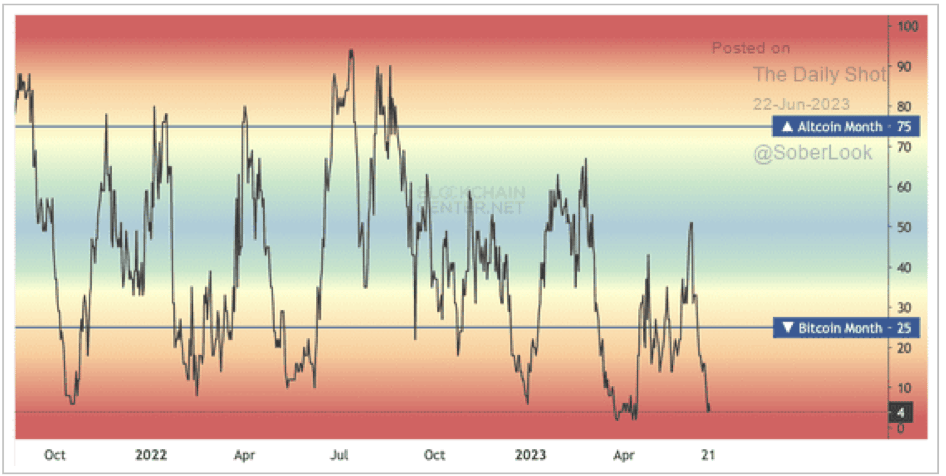

We've been witnessing a wild rally, and you won't believe what's been going down. Bitcoin, the big kahuna of crypto, has been crushing it and leaving most altcoins in the dust. Only a measly 4% of those alternative cryptos managed to outshine Bitcoin in the past month. Talk about a power move!

Now, this trend is worth paying attention to because usually, during risk-on phases, traders go gaga over higher-risk assets like altcoins. They ditch the safe bets, like Bitcoin, and go for the flashy stuff. But not this time, my friends. Traders seem to be playing it safe and showing some serious caution, even though the overall market sentiment is as bullish as a raging bull on steroids.

Why the sudden change of heart?

Well, it seems like Bitcoin's got a few tricks up its digital sleeve. See, Bitcoin has this rock-solid reputation as the big boss of crypto. It's like the Fort Knox of the crypto world. So, when things get a bit shaky and uncertain, investors flock to Bitcoin for stability and safety. It's like their trusty lifeboat in the choppy seas of market volatility.

But what about those poor altcoins?

Why are they playing second fiddle?

Well, there are a bunch of factors at play here. For one, the whole crypto market is under the microscope, facing increased scrutiny and regulatory concerns. That's enough to make even the most adventurous traders think twice before diving into altcoins. Plus, Bitcoin's got some serious street cred with institutional investors. It's got higher liquidity and wider acceptance, making it the go-to choice for the big boys.

So there you have it, folks. Bitcoin's the star of the show, outshining those altcoins left and right. Traders are being all cautious and risk-averse, seeking stability in the wild world of crypto.

In terms of price action, there isnt much going on, we briefly seen a small dip earlier today before prices pumped back up above $30,000.

TradFi Outlook 👀

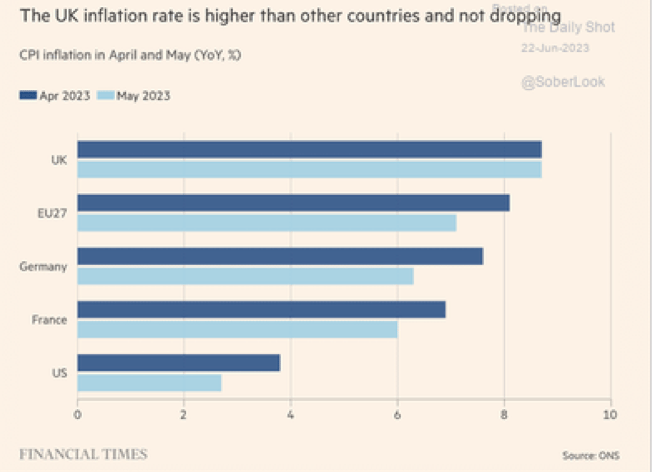

The Bank of England just dropped a bombshell on the market!

They pulled off a surprising move and jacked up interest rates by a whopping 50 basis points. This ain't no small fry hike btw. It's their 13th consecutive increase as those policymakers try to tackle sky-high inflation.

But here's the kicker—the market was only expecting a 25 basis point bump with a 60% chance. As soon as the news hit the wires, GBPUSD took a dive.

The folks on the Monetary Policy Committee had their reasons for this shocker though. They pointed out that recent data has been all kinds of positive, showing persistence in the inflation process. Plus, the tight labor market and strong demand are making things even trickier. So they figured it was time to take some bold steps.

Now, let's switch gears and talk about the US stock market.

Brace yourselves, people. Stock futures took a nosedive after three straight days of downturns. Looks like the tech-powered rally is running out of steam. The SP500 had a rough day, sliding by 0.5% yesterday. That's its worst performance for the whole month of June. And get this—it's on track to break a five-week winning streak with a 1% decline so far this week.

It's like the market's luck just turned.

And here's another twist to the tale. Fed Chair Jerome Powell decided to rain on everyone's parade.

In his remarks, he hinted that there might be more interest rate hikes in the future to tackle that pesky inflation. Investors were hoping the central bank was wrapping up its tightening cycle, but Powell threw 'em a curveball.

“Inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go,”

SEC v Crypto (What were they thinking!) 🧐

The tweet below highlights something we find HILARIOUS!

Basically, the SEC tried to freeze Binance US accounts. They did this on the basis that Binance was sending money abroad.

But when asked “have Binance actually sent any money”….

They said no…

Lmao @ Binance v. SEC #FireGensler

Court: "I want to know, are BAM assets going offshore? Is it happening or is it not? It's stunning to me that I've now asked this question to each of the SEC attorneys 5 times."

SEC: "So currently the assets are not going offshore... We're not… twitter.com/i/web/status/1…

— Tree of Alpha (@Tree_of_Alpha)

4:29 PM • Jun 21, 2023

This just completely goes to show that the SEC is completely WILDIN with this case against Binance. It also brings alot of confidence to investors in regards to Binance. If the SEC had to lie about this… then what else are they making up.

I think this comes back to the point that the higher ups are looking to trash crypto while their friends get in behind the scenes. (Blackrock etc)

Make sure to check out yesterdays article to see the theory…

Crypto Word of the Day 🤌🏽